Best High Net Worth Wealth Management Solutions for Global Families sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. In this guide, we will delve into the intricacies of managing wealth for high net-worth individuals and explore the challenges and best practices in this specialized field.

As we navigate through the complexities of tailored wealth management solutions for global families, we will uncover key factors to consider when choosing the right approach and highlight the top features of reputable wealth management firms in this sector.

Overview of High Net Worth Wealth Management Solutions

High net worth individuals are those who possess significant financial assets and investments, typically exceeding a certain threshold. These individuals require specialized wealth management solutions tailored to their unique needs and goals.

The Importance of Tailored Wealth Management Solutions

For high net worth individuals and global families, generic financial planning strategies are often inadequate. Tailored wealth management solutions take into account their complex financial situations, diverse assets, and specific objectives. These customized approaches provide personalized guidance and support to help maximize wealth growth, preserve assets, and achieve long-term financial success.

Key Challenges Faced by Global Families in Managing their Wealth

- Complexity of Assets: Global families often have diverse investment portfolios, real estate holdings, and business interests spread across multiple countries. Managing and optimizing these complex assets require specialized expertise and strategies.

- Taxation and Regulatory Compliance: Navigating tax laws and regulatory requirements in different jurisdictions can be challenging for global families. Effective wealth management solutions must ensure compliance while minimizing tax liabilities.

- Legacy and Succession Planning: Planning for the transfer of wealth to future generations involves complex legal and financial considerations. Wealth management solutions help global families develop comprehensive succession plans to preserve their legacies.

- Risk Management: High net worth individuals face unique risks, such as market volatility, geopolitical uncertainties, and unexpected events. Wealth management solutions incorporate risk management strategies to protect assets and mitigate potential losses.

Factors to Consider when Choosing Wealth Management Solutions

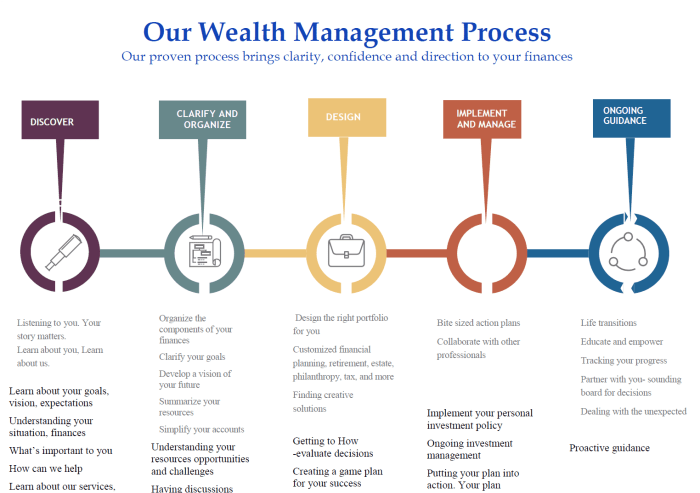

When selecting wealth management solutions for high net worth global families, it is crucial to consider various factors to ensure that their specific needs are met effectively. It is essential to compare traditional wealth management approaches with modern solutions and understand the role of technology in enhancing wealth management for global families.

When selecting wealth management solutions for high net worth global families, it is crucial to consider various factors to ensure that their specific needs are met effectively. It is essential to compare traditional wealth management approaches with modern solutions and understand the role of technology in enhancing wealth management for global families.Identifying Specific Needs of High Net Worth Global Families

High net worth global families have unique financial requirements that go beyond standard wealth management services. These families often have complex assets, diverse investments, multiple properties across different countries, and specific goals for wealth preservation and growth. Understanding these specific needs is vital to tailor wealth management solutions that align with their objectives and preferences.Comparing Traditional vs. Modern Wealth Management Approaches

Traditional wealth management approaches typically focus on conservative investment strategies, long-term financial planning, and personalized advisory services. In contrast, modern solutions leverage advanced technology, data analytics, and automation to offer real-time portfolio monitoring, risk assessment, and customized investment opportunities. By comparing these approaches, high net worth global families can determine which method aligns best with their financial goals and preferences.The Role of Technology in Enhancing Wealth Management

Technology plays a crucial role in enhancing wealth management for global families by providing access to real-time financial data, secure communication channels, and digital platforms for investment management. Automated tools and algorithms can help optimize investment decisions, minimize risks, and improve overall portfolio performance. By embracing technology-driven solutions, high net worth global families can streamline their wealth management processes, increase efficiency, and achieve their financial objectives more effectively.Best Practices in High Net Worth Wealth Management

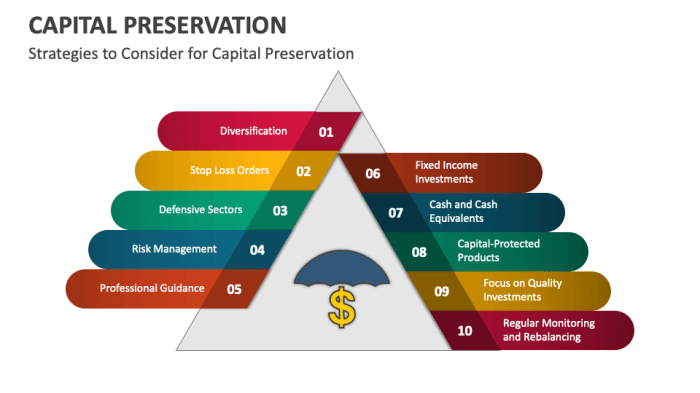

Importance of Diversification

Diversification is a key strategy in high net worth wealth management as it helps to spread risk across different asset classes, industries, and geographic regions. By diversifying a portfolio, wealth managers can reduce the impact of volatility in any one particular investment, ultimately helping to protect and grow their clients' wealth over the long term.- Allocating assets across various asset classes such as stocks, bonds, real estate, and alternative investments.

- Investing in companies from different industries to minimize sector-specific risks.

- Considering global diversification to reduce exposure to any one country's economic fluctuations.

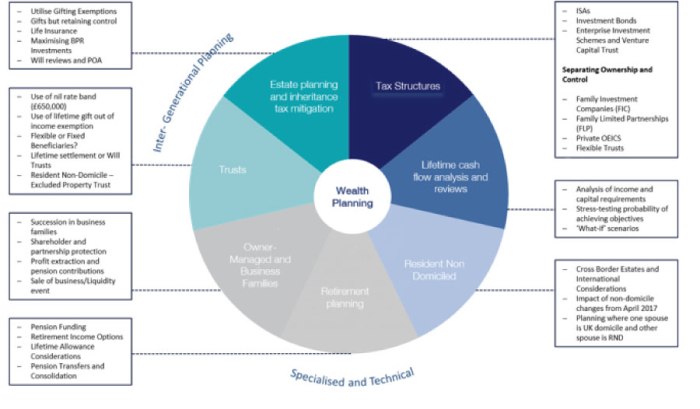

Role of Tax Planning and Asset Protection

Tax planning and asset protection are integral components of high net worth wealth management solutions. Efficient tax planning can help minimize tax liabilities and maximize after-tax returns, while asset protection strategies can safeguard assets from various risks and legal threats.- Utilizing tax-efficient investment vehicles such as trusts, IRAs, and 401(k)s to optimize tax benefits.

- Implementing estate planning strategies to minimize estate taxes for future generations.

- Utilizing insurance products to protect assets from unforeseen events such as lawsuits or creditors.

Key Features of Top High Net Worth Wealth Management Firms

When it comes to choosing a wealth management firm for global families with high net worth, certain key features set the top firms apart. These characteristics are crucial in providing the best financial solutions and services to meet the unique needs of affluent clients.Personalized Services

One of the most important features of top high net worth wealth management firms is their focus on personalized services. These firms understand that each client has unique financial goals, risk tolerances, and preferences. As such, they tailor their services to meet the individual needs of their clients, providing customized investment strategies, financial planning, and wealth preservation solutions.

Investment Strategies

Leading wealth management firms employ sophisticated investment strategies to help their high net worth clients grow and preserve their wealth. These firms have access to a wide range of investment opportunities, including alternative investments, private equity, and hedge funds. They also have a deep understanding of global markets and economic trends, allowing them to make informed investment decisions on behalf of their clients.

Conclusion

In conclusion, Best High Net Worth Wealth Management Solutions for Global Families encapsulates the essence of strategic financial planning for affluent individuals and families worldwide. By implementing the best practices and utilizing modern approaches, wealth managers can navigate the challenges effectively and ensure sustainable growth for their clients' portfolios.

FAQ Guide

What are the specific needs of high net worth global families?

High net worth global families require personalized and diversified wealth management solutions that cater to their unique financial goals and risk tolerance levels. These solutions often involve sophisticated investment strategies and tax planning to maximize returns and protect assets.

How does technology enhance wealth management for global families?

Technology plays a crucial role in wealth management for global families by providing real-time insights, automated portfolio monitoring, and secure communication channels between clients and wealth managers. This enables more efficient decision-making and seamless collaboration in managing complex financial portfolios.

Best High Net Worth Wealth Management Solutions for Global Families sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. In this guide, we will delve into the intricacies of managing wealth for high net-worth individuals and explore the challenges and best practices in this specialized field.

As we navigate through the complexities of tailored wealth management solutions for global families, we will uncover key factors to consider when choosing the right approach and highlight the top features of reputable wealth management firms in this sector.

Overview of High Net Worth Wealth Management Solutions

High net worth individuals are those who possess significant financial assets and investments, typically exceeding a certain threshold. These individuals require specialized wealth management solutions tailored to their unique needs and goals.

The Importance of Tailored Wealth Management Solutions

For high net worth individuals and global families, generic financial planning strategies are often inadequate. Tailored wealth management solutions take into account their complex financial situations, diverse assets, and specific objectives. These customized approaches provide personalized guidance and support to help maximize wealth growth, preserve assets, and achieve long-term financial success.

Key Challenges Faced by Global Families in Managing their Wealth

- Complexity of Assets: Global families often have diverse investment portfolios, real estate holdings, and business interests spread across multiple countries. Managing and optimizing these complex assets require specialized expertise and strategies.

- Taxation and Regulatory Compliance: Navigating tax laws and regulatory requirements in different jurisdictions can be challenging for global families. Effective wealth management solutions must ensure compliance while minimizing tax liabilities.

- Legacy and Succession Planning: Planning for the transfer of wealth to future generations involves complex legal and financial considerations. Wealth management solutions help global families develop comprehensive succession plans to preserve their legacies.

- Risk Management: High net worth individuals face unique risks, such as market volatility, geopolitical uncertainties, and unexpected events. Wealth management solutions incorporate risk management strategies to protect assets and mitigate potential losses.

Factors to Consider when Choosing Wealth Management Solutions

When selecting wealth management solutions for high net worth global families, it is crucial to consider various factors to ensure that their specific needs are met effectively. It is essential to compare traditional wealth management approaches with modern solutions and understand the role of technology in enhancing wealth management for global families.

When selecting wealth management solutions for high net worth global families, it is crucial to consider various factors to ensure that their specific needs are met effectively. It is essential to compare traditional wealth management approaches with modern solutions and understand the role of technology in enhancing wealth management for global families.Identifying Specific Needs of High Net Worth Global Families

High net worth global families have unique financial requirements that go beyond standard wealth management services. These families often have complex assets, diverse investments, multiple properties across different countries, and specific goals for wealth preservation and growth. Understanding these specific needs is vital to tailor wealth management solutions that align with their objectives and preferences.Comparing Traditional vs. Modern Wealth Management Approaches

Traditional wealth management approaches typically focus on conservative investment strategies, long-term financial planning, and personalized advisory services. In contrast, modern solutions leverage advanced technology, data analytics, and automation to offer real-time portfolio monitoring, risk assessment, and customized investment opportunities. By comparing these approaches, high net worth global families can determine which method aligns best with their financial goals and preferences.The Role of Technology in Enhancing Wealth Management

Technology plays a crucial role in enhancing wealth management for global families by providing access to real-time financial data, secure communication channels, and digital platforms for investment management. Automated tools and algorithms can help optimize investment decisions, minimize risks, and improve overall portfolio performance. By embracing technology-driven solutions, high net worth global families can streamline their wealth management processes, increase efficiency, and achieve their financial objectives more effectively.Best Practices in High Net Worth Wealth Management

Importance of Diversification

Diversification is a key strategy in high net worth wealth management as it helps to spread risk across different asset classes, industries, and geographic regions. By diversifying a portfolio, wealth managers can reduce the impact of volatility in any one particular investment, ultimately helping to protect and grow their clients' wealth over the long term.- Allocating assets across various asset classes such as stocks, bonds, real estate, and alternative investments.

- Investing in companies from different industries to minimize sector-specific risks.

- Considering global diversification to reduce exposure to any one country's economic fluctuations.

Role of Tax Planning and Asset Protection

Tax planning and asset protection are integral components of high net worth wealth management solutions. Efficient tax planning can help minimize tax liabilities and maximize after-tax returns, while asset protection strategies can safeguard assets from various risks and legal threats.- Utilizing tax-efficient investment vehicles such as trusts, IRAs, and 401(k)s to optimize tax benefits.

- Implementing estate planning strategies to minimize estate taxes for future generations.

- Utilizing insurance products to protect assets from unforeseen events such as lawsuits or creditors.

Key Features of Top High Net Worth Wealth Management Firms

When it comes to choosing a wealth management firm for global families with high net worth, certain key features set the top firms apart. These characteristics are crucial in providing the best financial solutions and services to meet the unique needs of affluent clients.Personalized Services

One of the most important features of top high net worth wealth management firms is their focus on personalized services. These firms understand that each client has unique financial goals, risk tolerances, and preferences. As such, they tailor their services to meet the individual needs of their clients, providing customized investment strategies, financial planning, and wealth preservation solutions.

Investment Strategies

Leading wealth management firms employ sophisticated investment strategies to help their high net worth clients grow and preserve their wealth. These firms have access to a wide range of investment opportunities, including alternative investments, private equity, and hedge funds. They also have a deep understanding of global markets and economic trends, allowing them to make informed investment decisions on behalf of their clients.

Conclusion

In conclusion, Best High Net Worth Wealth Management Solutions for Global Families encapsulates the essence of strategic financial planning for affluent individuals and families worldwide. By implementing the best practices and utilizing modern approaches, wealth managers can navigate the challenges effectively and ensure sustainable growth for their clients' portfolios.

FAQ Guide

What are the specific needs of high net worth global families?

High net worth global families require personalized and diversified wealth management solutions that cater to their unique financial goals and risk tolerance levels. These solutions often involve sophisticated investment strategies and tax planning to maximize returns and protect assets.

How does technology enhance wealth management for global families?

Technology plays a crucial role in wealth management for global families by providing real-time insights, automated portfolio monitoring, and secure communication channels between clients and wealth managers. This enables more efficient decision-making and seamless collaboration in managing complex financial portfolios.