Delving into the realm of investment firms catering to high net worth clients in Asia and Europe unveils a world of opportunities and tailored services designed to meet the unique needs of affluent individuals. This guide offers an insightful exploration into the top firms, investment strategies, and client services that define the landscape for high net worth investors.

Overview of Investment Firms

High net worth clients are individuals or families with substantial financial assets and investments, typically ranging in the millions or billions of dollars. These clients often have complex financial needs and seek specialized services to manage and grow their wealth.

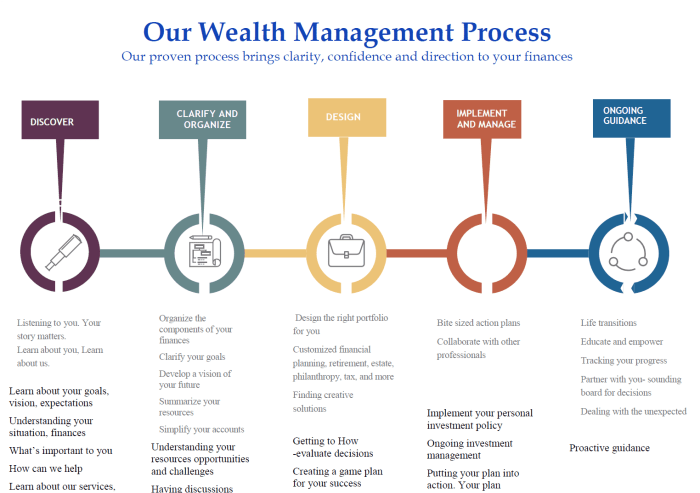

Investment firms play a crucial role in providing tailored investment solutions and financial advice to high net worth clients. These firms offer a range of services to help clients achieve their financial goals, preserve wealth, and plan for the future.

Services Offered by Investment Firms for High Net Worth Clients

- Portfolio Management: Investment firms create customized investment portfolios based on the client's risk tolerance, financial goals, and time horizon.

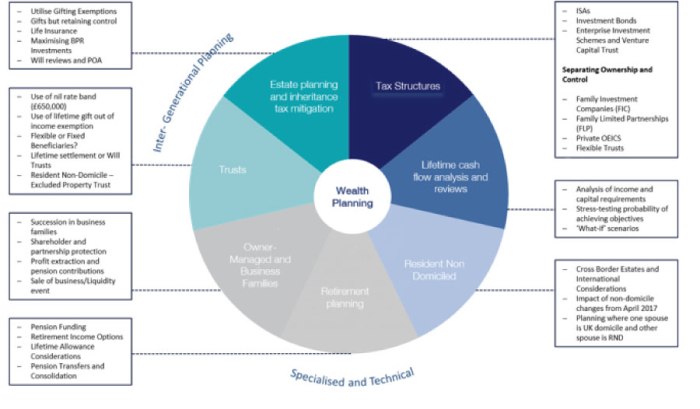

- Wealth Planning: Firms help clients develop comprehensive wealth management strategies, including estate planning, tax optimization, and retirement planning.

- Alternative Investments: Investment firms provide access to alternative investment opportunities such as private equity, hedge funds, and real estate to diversify the client's portfolio.

- Financial Advisory: Firms offer personalized financial advice on a wide range of topics, including asset allocation, investment selection, and wealth transfer.

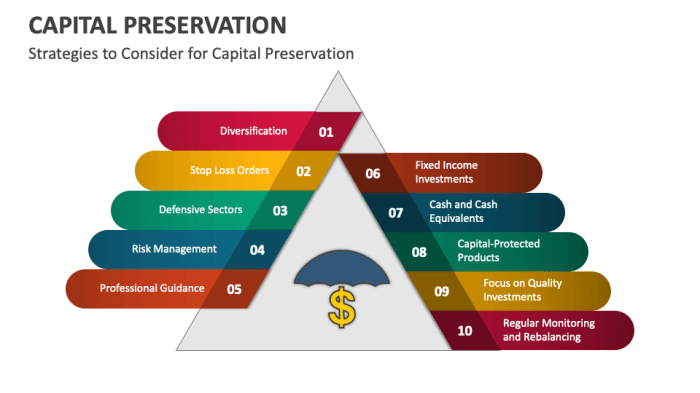

- Risk Management: Investment firms help high net worth clients mitigate risk through asset protection strategies, insurance solutions, and hedging techniques.

Top Investment Firms in Asia and Europe

When it comes to catering to high net worth clients, Asia and Europe have some of the best investment firms in the world. These firms offer a wide range of services and expertise to meet the unique needs of affluent individuals.

Best Investment Firms in Asia

Asia is home to several prestigious investment firms that provide top-notch services to high net worth clients. Here are some of the best investment firms in Asia:

- UBS Wealth Management - Known for its global reach and expertise in wealth management, UBS caters to high net worth clients across Asia.

- Credit Suisse - With a strong presence in Asia, Credit Suisse offers personalized investment solutions for affluent individuals.

- DBS Private Bank - A leading private bank in Asia, DBS provides tailored wealth management services to high net worth clients.

Best Investment Firms in Europe

Europe is also home to renowned investment firms that specialize in serving high net worth clients. Here are some of the top investment firms in Europe:

- BlackRock - A prominent asset management firm in Europe, BlackRock offers a wide range of investment solutions for affluent individuals.

- UBS Wealth Management - UBS is not only a key player in Asia but also a major player in Europe, providing comprehensive wealth management services to high net worth clients.

- HSBC Private Banking - With a long-standing reputation in Europe, HSBC Private Banking offers tailored financial solutions for affluent clients.

When comparing the key features and offerings of these investment firms in Asia and Europe, it is evident that they all prioritize personalized services, global expertise, and innovative investment solutions to meet the diverse needs of high net worth clients. Whether it's wealth management, asset allocation, or financial planning, these top investment firms excel in delivering exceptional services to their affluent clientele.

Investment Strategies for High Net Worth Clients

High net worth clients often utilize a variety of investment strategies to grow and protect their wealth. These strategies are tailored to their financial goals, risk tolerance, and unique circumstances.Common Investment Strategies

- Equity Investments: High net worth clients often invest in individual stocks or equity funds to achieve long-term capital growth.

- Fixed-Income Investments: Bonds and other fixed-income securities are popular for generating stable income streams while preserving capital.

- Alternative Investments: This includes investments in real estate, private equity, hedge funds, and commodities to diversify the portfolio and enhance returns.

Importance of Diversification

Diversification is crucial for high net worth clients to manage risk and maximize returns. By spreading investments across different asset classes, industries, and regions, they can reduce the impact of market volatility on their overall portfolio.Comparison of Traditional and Modern Strategies

| Traditional Strategies | Modern Strategies |

|---|---|

| Focus on individual stock picking. | Emphasis on passive investing through index funds and ETFs. |

| Reliance on mutual funds for diversification |

Utilization of robo-advisors for automated portfolio management. |

| Limited exposure to alternative investments. | Increased allocation to alternative assets for higher potential returns. |

Relationship Management and Client Services

Personalized relationship management plays a crucial role in catering to the needs of high net worth clients. By providing tailored services and building strong relationships, investment firms can ensure client satisfaction and loyalty.Exclusive Client Services Offered by Investment Firms

- Customized Investment Portfolios: Investment firms in Asia and Europe offer bespoke investment portfolios tailored to the specific goals and risk tolerance of high net worth clients.

- Dedicated Relationship Managers: High net worth clients are assigned dedicated relationship managers who provide personalized financial advice and guidance.

- Access to Exclusive Investment Opportunities: Clients are given access to exclusive investment opportunities such as private equity deals, hedge funds, and pre-IPO placements.

- Concierge Services: Some investment firms provide concierge services to assist clients with various non-financial needs such as travel arrangements, event planning, and luxury purchases.

Impact of Excellent Client Service

Excellent client service has a significant impact on client retention and satisfaction. By offering exceptional service, investment firms can enhance client loyalty, attract referrals, and differentiate themselves from competitors. Moreover, satisfied clients are more likely to entrust their assets to the firm for the long term, leading to increased revenue and profitability.Concluding Remarks

In conclusion, the landscape of investment firms for high net worth clients in Asia and Europe is rich with diversity and sophistication. From personalized relationship management to exclusive client services, these firms are dedicated to providing exceptional experiences for their discerning clientele. As high net worth individuals navigate the complexities of the financial world, these investment firms stand as pillars of support and expertise, guiding their clients towards financial success and prosperity.

Essential Questionnaire

What are high net worth clients?

High net worth clients are individuals or households with significant financial assets and investments, typically exceeding a certain threshold.

Why is diversification important for high net worth clients?

Diversification helps spread risk across various investments, reducing the impact of volatility on a high net worth client's portfolio.

How do traditional investment approaches differ from modern strategies for high net worth clients?

Traditional approaches may focus on long-term growth, while modern strategies often involve alternative investments and more active portfolio management tailored to the client's specific goals and risk tolerance.

What role does personalized relationship management play for high net worth clients?

Personalized relationship management is crucial for building trust, understanding client needs, and providing tailored investment solutions that align with their financial objectives.

How does excellent client service impact client retention and satisfaction?

Excellent client service enhances client satisfaction, fosters long-term relationships, and increases the likelihood of client retention and referrals within the high net worth segment.