Delving into the realm of High Net Worth Wealth Management Trends to Watch in 2025, this paragraph sets the stage for a captivating exploration, drawing readers in with intriguing insights and revelations.

The following paragraphs will provide a detailed overview of the key technologies, global economic trends, regulatory landscape, and digital transformation shaping wealth management for high net worth individuals in 2025.

High Net Worth Wealth Management Trends to Watch in 2025

In the realm of high net worth wealth management, several key technologies are expected to shape the landscape in 2025. These technologies are poised to revolutionize personalized wealth management services for high net worth clients, offering new opportunities and challenges.AI and Machine Learning Revolutionizing Personalized Wealth Management

Artificial Intelligence (AI) and machine learning algorithms are increasingly being utilized to provide personalized wealth management services to high net worth individuals. These technologies can analyze vast amounts of data in real-time, allowing for more accurate and tailored investment strategies. For example, AI-powered robo-advisors can offer customized investment advice based on an individual's risk tolerance, financial goals, and market trends. This level of personalization can enhance the client experience and improve investment outcomes.Impact of Blockchain and Cryptocurrencies on Financial Strategies

Blockchain technology and cryptocurrencies are also expected to have a significant impact on the financial strategies of high net worth individuals in 2025. Blockchain offers increased security, transparency, and efficiency in financial transactions, making it an attractive option for wealth management. Cryptocurrencies, such as Bitcoin and Ethereum, provide alternative investment opportunities that can diversify a high net worth individual's portfolio. However, the volatile nature of cryptocurrencies also presents risks that must be carefully considered in wealth management strategies.Global Economic Trends

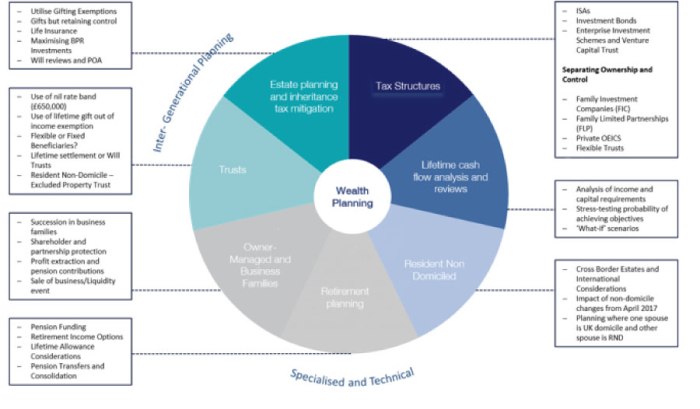

The global economic landscape is continually evolving, impacting the wealth management strategies of high net worth individuals in various ways. Geopolitical shifts, emerging markets, changing consumer behaviors, and the rise of sustainability and ESG factors are all playing crucial roles in shaping the investment decisions of high net worth clients.

The global economic landscape is continually evolving, impacting the wealth management strategies of high net worth individuals in various ways. Geopolitical shifts, emerging markets, changing consumer behaviors, and the rise of sustainability and ESG factors are all playing crucial roles in shaping the investment decisions of high net worth clients.Geopolitical Shifts and Global Economic Trends

Geopolitical shifts, such as trade tensions, political instability, and regulatory changes, have a direct impact on the global economy. High net worth individuals need to stay informed about these developments to adjust their investment portfolios accordingly and mitigate risks.Emerging Markets and Investment Decisions

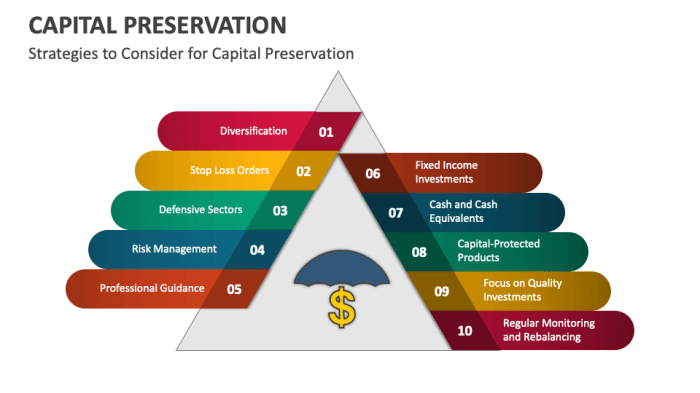

The growth of emerging markets presents both opportunities and challenges for high net worth individuals. Investing in these markets can offer high returns, but it also comes with higher volatility and regulatory risks. Wealth managers need to navigate these complexities to optimize their clients' investment portfolios.Sustainability and ESG Factors in Wealth Management

Sustainability and Environmental, Social, and Governance (ESG) factors are becoming increasingly important for high net worth individuals. Many clients are now seeking investments that align with their values, such as renewable energy projects, social impact funds, and companies with strong ethical practices. Wealth managers must integrate these considerations into their wealth management strategies to meet the evolving needs of their clients.Regulatory Landscape

The regulatory landscape plays a critical role in shaping the practices of high net worth wealth management. Changes in regulations and compliance requirements have a significant impact on how wealth managers interact with their clients and manage their investments.Regional Contrasts in Regulatory Environments

In different regions around the world, the regulatory environments for wealth management can vary significantly. For example, in the United States, the Securities and Exchange Commission (SEC) oversees the industry with a focus on investor protection and market integrity. On the other hand, in Europe, the Markets in Financial Instruments Directive (MiFID) aims to harmonize regulation across the European Union and enhance investor protection- These varying regulatory frameworks pose challenges for wealth managers operating globally, as they must navigate different compliance requirements and reporting standards.

- Furthermore, the differences in regulations can impact the investment strategies that wealth managers can employ for their high net worth clients.

- Staying abreast of regulatory developments in multiple regions is crucial for wealth managers to ensure they are operating within the bounds of the law and providing the best possible service to their clients.

Impact of Regulatory Developments on Wealth Management Services

Regulatory developments are continuously shaping the future of wealth management services for high net worth clients. For instance, the increasing focus on transparency and disclosure requirements means that wealth managers need to provide more detailed information to their clients about their investments and fees.Adapting to these regulatory changes requires wealth managers to invest in technology and talent to ensure compliance and provide enhanced services to their clients.

- Regulatory developments also influence the types of products and services that wealth managers can offer, as certain investment options may become restricted or require additional oversight.

- Fostering a culture of compliance within wealth management firms is crucial to navigating the evolving regulatory landscape and maintaining the trust of high net worth clients.

Digital Transformation

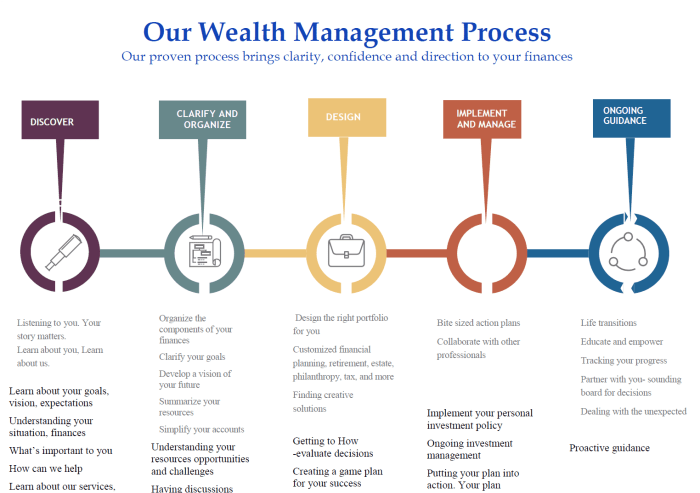

Digital transformation plays a pivotal role in enhancing the client experience for high net worth individuals in the wealth management sector. By leveraging innovative digital tools and platforms, wealth managers can streamline processes, provide personalized services, and improve overall efficiency in managing their clients' wealth.Innovative Digital Tools and Platforms

- Robo-advisors: Automated investment platforms use algorithms to provide tailored investment advice based on client preferences and risk profiles.

- Mobile Apps: Wealth management firms are developing mobile applications that allow clients to track their investments, access financial reports, and communicate with their advisors on the go.

- Blockchain Technology: Implementing blockchain technology ensures secure and transparent transactions, reducing the risk of fraud in wealth management operations.

- Data Analytics: Utilizing data analytics tools helps wealth managers gain valuable insights into client behavior, preferences, and investment trends, enabling them to make informed decisions.

Challenges and Opportunities

- Challenges: One of the main challenges of digitalization in high net worth wealth management is data security and privacy concerns. There is also a need for continuous upskilling of wealth managers to adapt to new technologies and changing client demands.

- Opportunities: Digital transformation presents opportunities to reach a wider client base, provide more personalized services, and improve operational efficiency. It also allows for better risk management and compliance through automated processes.

Last Recap

In conclusion, the landscape of high net worth wealth management in 2025 is poised for significant transformation driven by technological advancements, economic shifts, regulatory changes, and digital innovations. Stay informed and prepared to navigate these evolving trends for a prosperous financial future.

FAQ Compilation

What are some key technologies shaping wealth management for high net worth individuals in 2025?

Some key technologies include AI, machine learning, blockchain, and cryptocurrencies, revolutionizing personalized wealth management services.

How are global economic trends influencing the wealth management strategies of high net worth individuals?

Global economic trends and geopolitical shifts impact investment decisions, while emerging markets and sustainability considerations play a significant role in shaping strategies.

What are the regulatory changes affecting high net worth wealth management practices?

Regulatory changes include compliance challenges, differing regulatory environments across regions, and their impact on wealth management strategies.

How does digital transformation enhance the client experience for high net worth individuals?

Digital tools and platforms improve client experience, offering innovative ways to conduct wealth management while presenting challenges and opportunities for growth.