Delve into the intricate world of high net worth advising as we explore how seasoned advisors navigate the realm of alternative investments. This captivating journey promises to shed light on the strategies and techniques employed by experts in managing diverse investment portfolios for high net worth individuals.

From understanding the nuances of alternative investments to implementing effective risk management strategies, this discussion offers valuable insights into the dynamic landscape of wealth management.

Understanding Alternative Investments

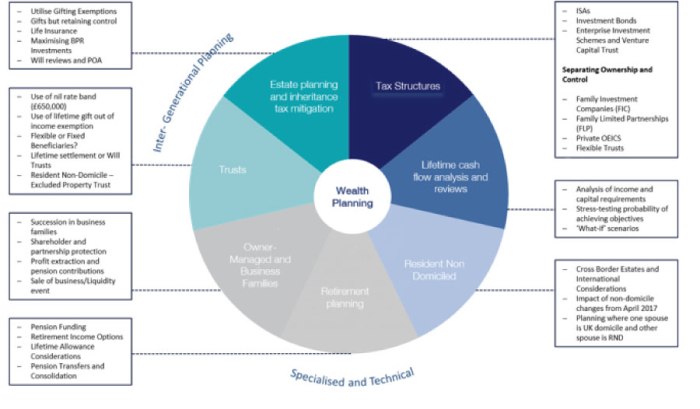

Alternative investments in the context of high net worth advising refer to investment options beyond traditional stocks, bonds, and cash. These non-traditional assets are usually less liquid and more complex, requiring a sophisticated approach to manage effectively.

Alternative investments in the context of high net worth advising refer to investment options beyond traditional stocks, bonds, and cash. These non-traditional assets are usually less liquid and more complex, requiring a sophisticated approach to manage effectively.Common Types of Alternative Investments

- Private Equity: Investing in private companies or privately-held businesses.

- Hedge Funds: Pooled investment funds that use various strategies to generate returns.

- Real Estate: Direct investment in properties or real estate investment trusts (REITs).

- Commodities: Investing in physical goods like gold, oil, or agricultural products.

- Venture Capital: Providing capital to start-up companies in exchange for equity.

Benefits of Including Alternative Investments

- Diversification: Alternative investments can help reduce overall portfolio risk by spreading investments across different asset classes.

- Potential for Higher Returns: Some alternative investments have the potential to generate higher returns compared to traditional assets.

- Protection Against Market Volatility: Alternative investments may perform differently than stocks and bonds, providing a hedge against market volatility.

- Access to Unique Opportunities: High net worth individuals can access exclusive investment opportunities not available to the general public through alternative investments.

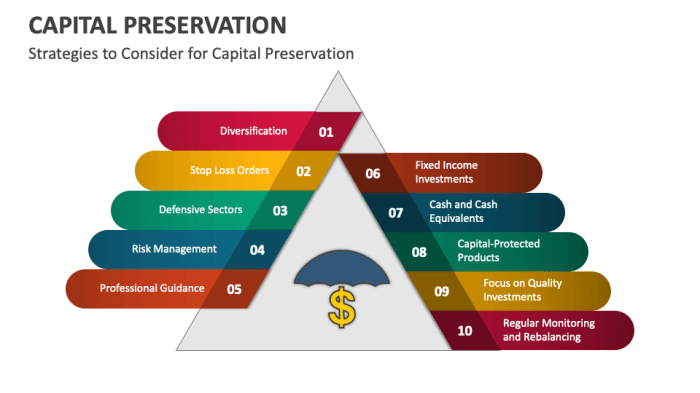

Risk Management Strategies

High net worth advisors understand the importance of implementing effective risk management strategies when dealing with alternative investments. These strategies are crucial in protecting their clients' wealth and maximizing returns in this complex investment landscape.Risk Assessment Techniques

When it comes to alternative investments, traditional risk assessment techniques may not always be sufficient. High net worth advisors often employ more sophisticated methods to evaluate the risks associated with these investments. They may use quantitative analysis, stress testing, scenario analysis, and other advanced tools to assess the potential risks and rewards of alternative investment opportunities.

Comparison of Risk Management Approaches

Compared to traditional investments, alternative investments typically carry higher risks due to their complexity and lack of liquidity. High net worth advisors need to adopt a more proactive and hands-on approach to managing these risks. While traditional investments may rely heavily on diversification, alternative investments require a deeper understanding of the underlying assets and market dynamics.

Examples of Risk Mitigation

- Due Diligence: High net worth advisors conduct thorough due diligence before investing in alternative assets to assess the quality of the investment opportunity and potential risks involved.

- Asset Allocation: Diversifying across different alternative investments can help mitigate risks associated with a single asset class or strategy.

- Hedging Strategies: Using hedging techniques such as options or futures contracts can help protect against downside risks in volatile markets.

- Regular Monitoring: Continuous monitoring of alternative investments allows advisors to identify and address risks in a timely manner.

Due Diligence Process

High net worth advisors follow a meticulous due diligence process when evaluating alternative investment opportunities. This involves a thorough examination of various factors to ensure the credibility and potential success of the investment.

High net worth advisors follow a meticulous due diligence process when evaluating alternative investment opportunities. This involves a thorough examination of various factors to ensure the credibility and potential success of the investment.Criteria for Assessing Credibility

- Track Record: Advisors look at the past performance of the alternative investment, including historical returns and volatility.

- Management Team: The expertise and experience of the management team are crucial in evaluating the credibility of the investment.

- Market Conditions: Understanding the market environment and how it may impact the investment is essential.

- Regulatory Compliance: Ensuring that the investment complies with all relevant regulations and standards.

Due Diligence for Alternative Investments vs. Traditional Asset Classes

Due diligence for alternative investments differs from traditional asset classes in several ways. Alternative investments often involve more complex structures and strategies, requiring a deeper level of analysis.

- Illiquidity: Alternative investments may have longer lock-up periods or limited liquidity compared to traditional assets like stocks and bonds.

- Risk Factors: Assessing risks associated with alternative investments, such as market risk, operational risk, and liquidity risk, requires a more nuanced approach.

- Transparency: Alternative investments may have less transparency compared to traditional assets, making it essential for advisors to conduct thorough due diligence.

Performance Monitoring and Reporting

Monitoring the performance of alternative investments is crucial for high net worth advisors to ensure the success of their portfolios. By implementing effective methods and utilizing key performance indicators (KPIs), advisors can make informed decisions and optimize the performance of these investments.Methods for Monitoring Performance

- Regular Performance Reviews: Advisors conduct regular reviews of alternative investments to track their performance over time and identify any trends or fluctuations.

- Comparative Analysis: By comparing the performance of alternative investments to relevant benchmarks or indices, advisors can assess how well these investments are performing in comparison to the market.

- Risk Assessment: Monitoring the risk associated with alternative investments is essential, as it allows advisors to evaluate the potential impact on overall portfolio performance.

Key Performance Indicators (KPIs)

- Return on Investment (ROI): Calculating the ROI of alternative investments helps advisors assess the profitability and effectiveness of these investments.

- Volatility: Monitoring the volatility of alternative investments provides insights into the level of risk and potential returns associated with these investments.

- Liquidity: Understanding the liquidity of alternative investments is important for assessing how easily these investments can be bought or sold without significantly impacting their value.

Reporting Structures for Alternative Investments

- Customized Reports: Advisors may create customized reports for alternative investments within a high net worth portfolio, tailored to the specific needs and preferences of the client.

- Transparency: Providing transparent and detailed reports on the performance of alternative investments helps clients understand how their investments are performing and the impact on their overall portfolio.

- Regular Updates: Advisors should ensure regular updates and communication with clients regarding the performance of alternative investments to maintain trust and transparency in the advisor-client relationship.

End of Discussion

In conclusion, the art of managing alternative investments as a high net worth advisor requires a delicate balance of knowledge, experience, and foresight. By staying informed, adapting to market trends, and embracing innovative approaches, advisors can optimize investment portfolios to achieve long-term financial success for their clients.

Question Bank

How do high net worth advisors define alternative investments?

Alternative investments encompass non-traditional assets such as private equity, hedge funds, real estate, and commodities, offering diversification beyond stocks and bonds.

What risk management techniques are specific to alternative investments?

Risk management for alternative investments involves thorough due diligence, stress testing, and active monitoring to mitigate unique risks associated with illiquid and complex assets.

How do high net worth advisors approach due diligence for alternative investments?

Advisors conduct in-depth research, assess manager track records, evaluate market conditions, and analyze legal structures to ensure the credibility and viability of alternative investment opportunities.

What key performance indicators are relevant to monitoring alternative investments?

Performance indicators such as internal rate of return (IRR), cash flow yield, and volatility measures are crucial for evaluating the success and effectiveness of alternative investment strategies.

How do reporting structures for alternative investments differ within high net worth portfolios?

Reporting for alternative investments often involves customized and detailed performance reports, alongside regular updates on fund performance, fees, and underlying asset valuations to provide transparency and accountability to clients.