How Private Wealth Management Aligns With Long-Term Financial Vision sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

The discussion delves into the intricacies of private wealth management and its harmonious relationship with long-term financial goals, providing valuable insights for individuals seeking financial stability and growth.

Understanding Private Wealth Management

Private wealth management involves the professional management of assets and investments for high-net-worth individuals or families. This specialized service goes beyond traditional financial planning to provide tailored strategies that optimize wealth growth and preservation.Role of Private Wealth Management in Financial Planning

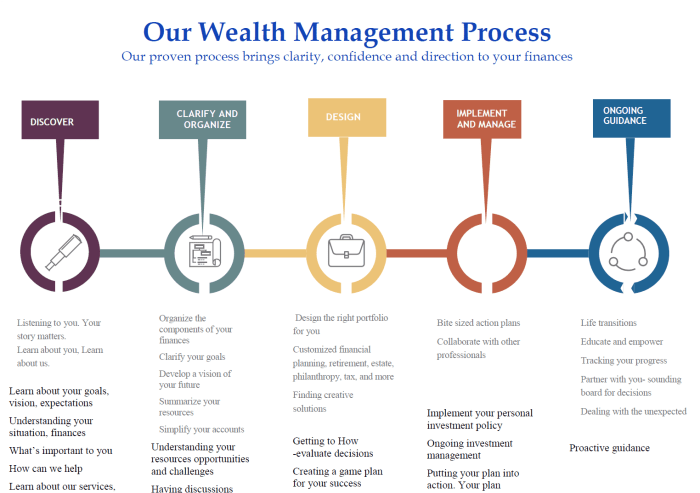

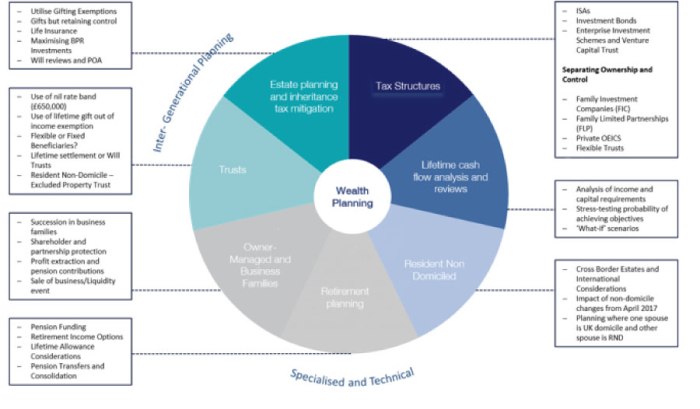

Private wealth management plays a crucial role in helping individuals and families achieve their long-term financial goals by creating personalized strategies that align with their unique objectives and risk tolerance. By taking a holistic approach to financial planning, private wealth managers can address various aspects of wealth management, including investments, tax planning, estate planning, and retirement planning.Importance of Aligning Private Wealth Management with Long-Term Financial Goals

Aligning private wealth management with long-term financial goals is essential for building and preserving wealth over time. By establishing clear objectives and developing a comprehensive plan, individuals can ensure that their wealth management strategies are aligned with their vision for the future. This alignment helps minimize risks, maximize returns, and adapt to changing circumstances while staying focused on the long-term objectives.Strategies in Private Wealth Management for Long-Term Financial Vision

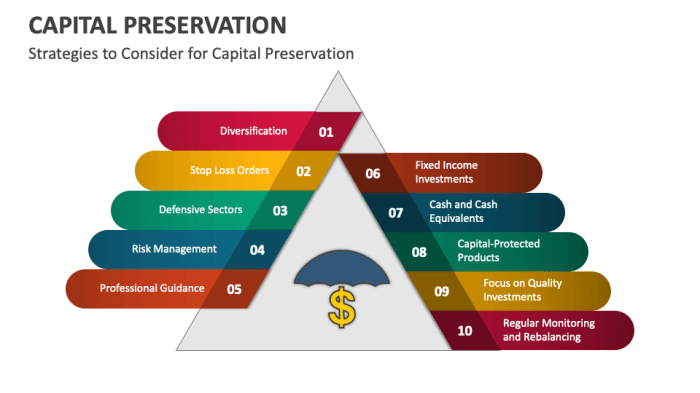

- Diversification: By spreading investments across different asset classes, sectors, and regions, private wealth managers reduce risk and enhance portfolio performance over the long term.

- Asset Allocation: Creating a strategic mix of assets based on risk tolerance, time horizon, and financial goals helps optimize returns and manage volatility.

- Tax Planning: Implementing tax-efficient strategies can maximize after-tax returns and preserve wealth for future generations.

- Estate Planning: Structuring wealth transfer plans and minimizing estate taxes ensure a smooth transition of assets to heirs and beneficiaries.

Building a Long-Term Financial Vision

Developing a long-term financial vision is crucial for individuals seeking to secure their financial future and achieve their goals over time. It involves setting clear objectives and creating a roadmap to guide financial decisions and actions.

Developing a long-term financial vision is crucial for individuals seeking to secure their financial future and achieve their goals over time. It involves setting clear objectives and creating a roadmap to guide financial decisions and actions.Key Components of a Comprehensive Long-Term Financial Vision

- Financial Goals: Clearly define short-term and long-term financial objectives, such as retirement savings, investment targets, debt management, and emergency funds.

- Risk Tolerance: Understand your risk tolerance level to align investments with your comfort level and long-term objectives.

- Asset Allocation: Determine the mix of assets within your portfolio to optimize returns based on your financial goals and risk profile.

- Tax Planning: Develop strategies to minimize tax liabilities and maximize after-tax returns on investments.

- Estate Planning: Include provisions for the transfer of wealth to heirs and beneficiaries in a tax-efficient manner.

Comparing Short-Term Financial Goals with Long-Term Financial Vision

Short-term financial goals are typically focused on immediate needs or objectives that can be achieved in the near future, such as paying off credit card debt, saving for a vacation, or buying a car. In contrast, a long-term financial vision encompasses broader aspirations and plans that extend over an extended period, such as funding children's education, purchasing a home, retiring comfortably, and leaving a legacy for future generations. While short-term goals are important for financial stability and motivation, a long-term financial vision provides a strategic framework for building wealth, achieving financial independence, and securing a prosperous future.Aligning Private Wealth Management with Long-Term Financial Vision

Investing in private wealth management requires a strategic approach to ensure that your financial goals are aligned with your long-term vision. By implementing the right strategies, managing risks effectively, and integrating tax planning, you can optimize your wealth management to support your long-term financial objectives.Strategies for Aligning Investments

- Diversification: Spread your investments across different asset classes to reduce risk and maximize returns over the long term.

- Asset Allocation: Determine the right mix of stocks, bonds, and other investments based on your risk tolerance and financial goals.

- Regular Review: Monitor your investments regularly to ensure they are in line with your long-term financial vision and make adjustments as necessary.

The Role of Risk Management

- Understanding Risk: Assess your risk tolerance and financial goals to develop a risk management strategy that aligns with your long-term vision.

- Diversification: By spreading your investments, you can mitigate risk and protect your wealth against market volatility.

- Insurance: Utilize insurance products to manage risk and protect your assets in the event of unforeseen circumstances.

Integrating Tax Planning

- Tax-Efficient Investing: Opt for investment strategies that minimize tax liabilities and maximize after-tax returns to support your long-term financial goals.

- Estate Planning: Develop a tax-efficient estate plan to ensure that your wealth is transferred to your beneficiaries in a tax-efficient manner.

- Utilizing Tax-Advantaged Accounts: Take advantage of retirement accounts and other tax-advantaged vehicles to optimize your tax planning within your wealth management strategy.

Monitoring and Adjusting Strategies

Regularly monitoring and reviewing private wealth management strategies is crucial to ensure they align with long-term financial vision. This ongoing evaluation helps to track progress, identify areas for improvement, and make necessary adjustments to stay on course towards financial goals.Evaluating Investment Performance

- Compare actual investment returns with projected returns to assess performance.

- Consider risk-adjusted returns to determine if investments are meeting expectations while managing risk effectively.

- Analyze portfolio diversification to ensure a balanced and well-allocated investment mix.

Necessitating Adjustments

- Changes in financial markets, such as economic conditions or interest rates, may require a reevaluation of investment strategies.

- Personal circumstances like a change in income, family situation, or financial goals may necessitate adjustments to wealth management strategies.

- Reviewing tax implications and adjusting strategies accordingly can optimize wealth management in changing circumstances.

Summary

In conclusion, aligning private wealth management with a long-term financial vision is not just a strategy but a mindset. It requires foresight, planning, and adaptability to navigate the ever-changing financial landscape effectively. By understanding the nuances of this alignment, individuals can pave the way for a secure financial future filled with opportunities for growth and prosperity.

Expert Answers

How can private wealth management help in achieving long-term financial goals?

Private wealth management offers personalized strategies and investment solutions tailored to an individual's specific financial objectives, thus helping align investments with long-term goals effectively.

What role does risk management play in private wealth management for long-term financial vision?

Risk management ensures that investments are diversified and protected against potential market volatility, safeguarding the long-term financial vision from unforeseen challenges.

How can tax planning be integrated into private wealth management to support long-term financial objectives?

By strategically planning tax implications on investments, individuals can optimize their financial resources and enhance long-term wealth accumulation within the framework of private wealth management.