As How PWM Finance Supports Shariah-Compliant Wealth Strategies takes center stage, this opening passage beckons readers with a casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

In this article, we will delve into the intersection of PWM Finance and Shariah-compliant wealth strategies, exploring how these two areas can harmoniously coexist to optimize financial growth and adherence to ethical principles.

Understanding PWM Finance

PWM Finance, short for Private Wealth Management Finance, is a specialized financial management service tailored for high-net-worth individuals and families. It goes beyond traditional financial management by providing personalized strategies to grow and preserve wealth while considering individual financial goals, risk tolerance, and lifestyle preferences.

Key Components of PWM Finance

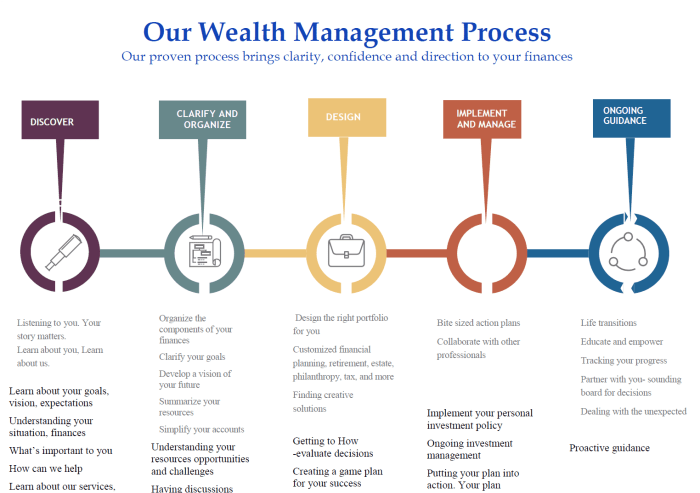

- Personalized Wealth Management Plans: PWM Finance creates customized wealth management plans based on the unique financial situation and goals of each client.

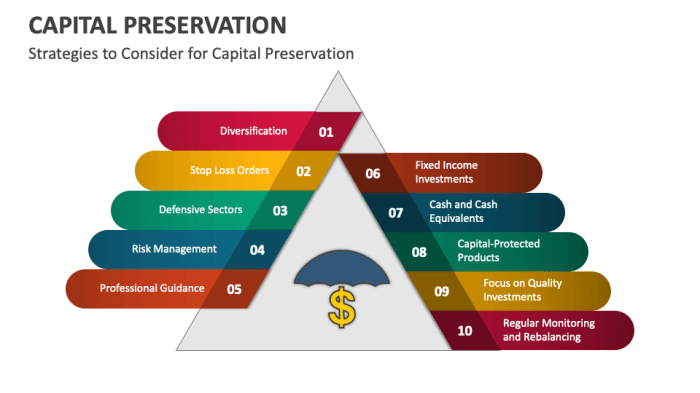

- Portfolio Diversification: PWM Finance emphasizes diversification across various asset classes to manage risk and optimize returns.

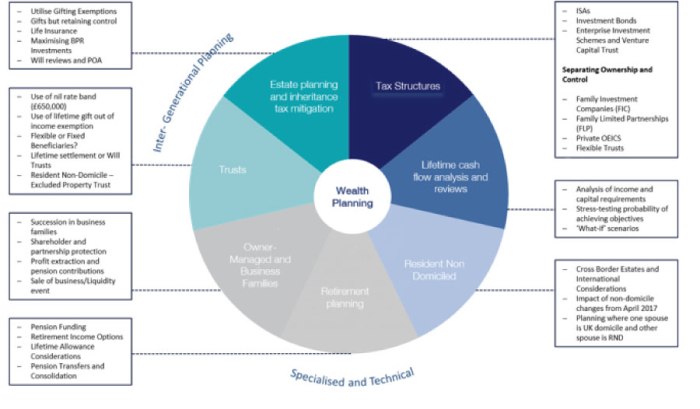

- Tax Planning and Optimization: PWM Finance includes tax-efficient strategies to minimize tax liabilities and maximize after-tax returns.

- Legacy Planning: PWM Finance helps clients plan for the transfer of wealth to future generations or charitable causes.

Shariah-Compliant Wealth Strategies

Shariah-compliant wealth strategies refer to financial planning and investment practices that adhere to Islamic principles Artikeld in Shariah law.

Principles of Shariah-Compliant Investing

- Avoidance of interest (Riba): Shariah-compliant investing prohibits earning or paying interest, as it is considered exploitative and unjust.

- Avoidance of uncertainty (Gharar): Investments with excessive uncertainty or ambiguity are not allowed, as they go against the principle of transparency.

- Avoidance of prohibited activities (Haram): Shariah-compliant investing excludes businesses involved in activities such as alcohol, gambling, pork, and other forbidden practices.

- Investing in ethical and socially responsible businesses: Shariah-compliant wealth strategies prioritize investments in companies that operate in a socially responsible manner and contribute positively to society.

Significance of Aligning Investments with Shariah Principles

Aligning investments with Shariah principles is crucial for Muslim investors who seek to grow their wealth in a way that is ethically and morally sound. By following Shariah-compliant wealth strategies, individuals can ensure that their investments are in line with their religious beliefs and values. This not only provides financial growth but also peace of mind knowing that their wealth has been acquired through permissible means.

Integration of PWM Finance and Shariah-Compliant Wealth Strategies

The integration of PWM Finance with Shariah-compliant wealth strategies brings together the principles of Islamic finance with modern wealth management practices. This alignment allows individuals to grow their wealth in a way that is consistent with their religious beliefs and values.

The integration of PWM Finance with Shariah-compliant wealth strategies brings together the principles of Islamic finance with modern wealth management practices. This alignment allows individuals to grow their wealth in a way that is consistent with their religious beliefs and values.Shariah-Compliant Investment Options in PWM Finance

- Islamic Equity Funds: These funds invest in Shariah-compliant companies that adhere to Islamic principles, such as avoiding businesses involved in alcohol, gambling, or other prohibited activities.

- Sukuk Investments: Sukuk are Islamic bonds that generate returns through asset ownership rather than interest payments, making them a popular choice for investors seeking halal investment opportunities.

- Real Estate Investment Trusts (REITs): Shariah-compliant REITs offer investors the opportunity to invest in real estate properties while adhering to Islamic finance principles.

Benefits of Integrating PWM Finance with Shariah-Compliant Wealth Strategies

- Alignment with Religious Beliefs: By investing in Shariah-compliant options, individuals can ensure that their wealth is grown in a manner that is consistent with Islamic teachings.

- Risk Management: Shariah-compliant investments often focus on tangible assets and ethical business practices, which can help reduce investment risks and promote long-term stability.

- Diversification: Integrating PWM Finance with Shariah-compliant wealth strategies allows for a diverse investment portfolio that can help mitigate risks and optimize returns over time.

Compliance and Regulations

When it comes to Shariah-compliant financial products, there is a strict regulatory framework in place to ensure adherence to Islamic principles. These regulations govern various aspects of financial transactions, investments, and wealth management to ensure that they are in line with Shariah law.

Regulatory Framework for Shariah-Compliant Financial Products

Shariah-compliant financial products are guided by principles derived from Islamic law, including the prohibition of interest (riba), uncertainty (gharar), and investments in businesses that are considered haram (forbidden). To ensure compliance, these products are overseen by Shariah boards comprised of Islamic scholars who certify that the products meet the required criteria.

It is crucial for financial institutions offering Shariah-compliant products to obtain certification from Shariah boards to ensure compliance with Islamic principles.

Importance of Compliance in PWM Finance

Compliance is of utmost importance in Private Wealth Management (PWM) Finance when it comes to Shariah-compliant investments. Investors who follow Islamic principles seek assurance that their wealth is managed in a manner that aligns with their religious beliefs. Any deviation from Shariah principles can result in financial losses and ethical concerns for investors.

Ensuring compliance in PWM Finance is not only a regulatory requirement but also a way to build trust and credibility with Shariah-compliant investors.

Ensuring Adherence to Shariah Principles

PWM Finance ensures adherence to Shariah principles through rigorous screening processes, ongoing monitoring, and regular audits. Investment opportunities are thoroughly evaluated to ensure they comply with Islamic guidelines, and any non-compliant activities are promptly addressed to mitigate risks.

By integrating Shariah screening criteria into their investment processes, PWM Finance firms can offer tailored wealth management solutions that meet the ethical standards of Shariah-compliant investors.

Final Review

In conclusion, the integration of PWM Finance with Shariah-compliant wealth strategies offers a promising path for investors seeking both financial success and ethical alignment in their portfolios. By understanding the principles and benefits Artikeld in this discussion, individuals can make informed decisions to navigate the complexities of modern wealth management with confidence.

FAQ Compilation

What are the key components of PWM Finance?

PWM Finance comprises personalized financial planning, investment management, and wealth protection strategies tailored to individual needs.

How does PWM Finance differ from traditional financial management?

PWM Finance offers a more holistic approach that considers individual values, goals, and risk tolerances, going beyond mere financial returns to encompass the broader financial well-being of clients.

What are some examples of Shariah-compliant investment options in PWM Finance?

Shariah-compliant investment options in PWM Finance may include equities of companies that adhere to Islamic principles, Sukuk (Islamic bonds), and Islamic mutual funds.

How does PWM Finance ensure compliance with Shariah principles?

PWM Finance rigorously screens investment options to ensure they align with Shariah principles, following strict guidelines to maintain ethical integrity in financial decisions.