Exploring the realm of Multi Family Office Services and their impact on global wealth control sets the stage for a fascinating journey into the world of high-net-worth financial management.

Delving deeper into the intricacies of Multi Family Offices and their role in shaping the financial landscapes of affluent families worldwide reveals a rich tapestry of tailored solutions and strategic approaches.

Overview of Multi Family Office Services

Multi Family Office services refer to comprehensive wealth management solutions tailored to meet the unique financial needs of affluent families. These services are designed to provide a high level of personalized attention and expertise to manage the complex financial affairs of wealthy individuals globally.

Role of Multi Family Offices in Managing Affluent Families' Finances

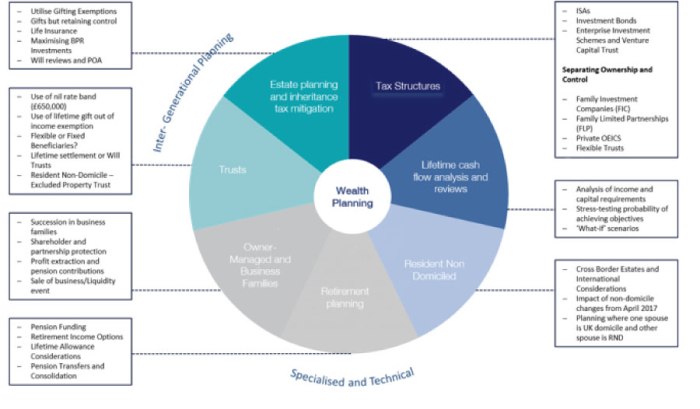

Multi Family Offices play a crucial role in overseeing the financial activities of affluent families, including investment management, estate planning, tax optimization, and philanthropic initiatives. By offering a wide range of services under one roof, these offices ensure that the financial interests of high-net-worth individuals are safeguarded and optimized.

Key Services Offered by Multi Family Offices

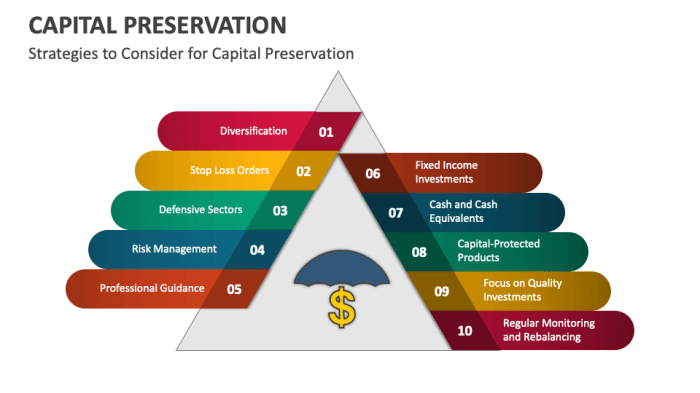

- Investment Management: Multi Family Offices provide tailored investment strategies to grow and preserve the wealth of their clients. They offer access to a diverse range of investment opportunities, including private equity, real estate, and alternative investments.

- Financial Planning: These offices create customized financial plans that align with the long-term goals and objectives of affluent families. They help in budgeting, cash flow management, retirement planning, and risk management.

- Estate Planning: Multi Family Offices assist in developing estate plans to ensure the smooth transfer of wealth to future generations. They help in minimizing estate taxes, establishing trusts, and creating strategies for wealth preservation.

- Tax Optimization: By leveraging their expertise in tax planning, Multi Family Offices help high-net-worth individuals reduce their tax liabilities and maximize their after-tax returns. They implement strategies to optimize tax efficiency across different jurisdictions.

Importance of Global Wealth Control

Global wealth control is a critical aspect for high-net-worth individuals, as it allows them to effectively manage their assets and investments on a global scale. By having control over their wealth across different countries and regions, affluent families can diversify their portfolios, mitigate risks, and seize opportunities in various markets.

Global wealth control is a critical aspect for high-net-worth individuals, as it allows them to effectively manage their assets and investments on a global scale. By having control over their wealth across different countries and regions, affluent families can diversify their portfolios, mitigate risks, and seize opportunities in various markets.Financial Stability and Security

Controlling global wealth contributes to financial stability and security by providing a layer of protection against economic uncertainties and geopolitical risks. High-net-worth individuals can strategically allocate their resources in stable economies, invest in diverse asset classes, and ensure long-term financial growth and sustainability

Challenges in Managing Wealth Across Borders

Affluent families face several challenges in managing wealth across international borders, including complex tax regulations, legal requirements, and cultural differences. Navigating these various obstacles requires expert knowledge, specialized strategies, and a network of professionals who understand the intricacies of global wealth management.

Role of Multi Family Offices in Enabling Global Wealth Control

Multi Family Offices play a crucial role in enabling effective global wealth control by providing specialized services tailored to the complex needs of high-net-worth individuals and families. These offices act as strategic partners in navigating the intricate global financial landscapes, offering personalized solutions to preserve and grow wealth across different jurisdictions.Assistance in Navigating Complex Global Financial Landscapes

Multi Family Offices assist clients in navigating the complexities of the global financial landscape by providing expertise in various areas such as tax planning, investment management, estate planning, and risk management. They help clients understand and comply with different regulatory environments, optimize investment opportunities, and mitigate risks associated with cross-border wealth management.

Specific Strategies Used for Optimizing Global Wealth Control

Multi Family Offices employ a range of strategies to optimize global wealth control, including asset allocation, diversification, tax optimization, philanthropic planning, and succession planning. By customizing these strategies to the unique needs and goals of each client, these offices ensure that wealth is effectively managed and preserved for future generations.

Examples of Successful Cases

One successful case where a Multi Family Office enabled effective global wealth control is the management of a multi-generational family's wealth across multiple countries. By coordinating investment strategies, tax planning, and estate planning efforts, the Multi Family Office helped the family maintain and grow their wealth while ensuring compliance with relevant regulations in each jurisdiction. Another example is the structuring of an international real estate portfolio to optimize returns and minimize tax liabilities, demonstrating the value of specialized expertise in navigating complex global financial landscapes.

Customized Solutions Offered by Multi Family Offices

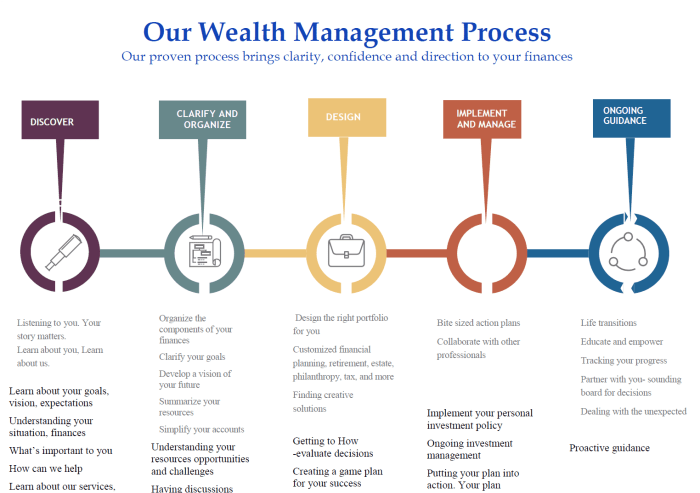

Multi Family Offices are known for providing tailored solutions to meet the unique needs of each client. These customized services allow clients to receive personalized wealth management plans designed specifically for their individual financial goals and preferences.

Flexibility and Adaptability of Multi Family Office Services

Multi Family Offices offer a high level of flexibility and adaptability to cater to clients in different global contexts. Whether a client is based in the United States, Europe, Asia, or any other part of the world, Multi Family Offices can adjust their services to comply with local regulations, tax laws, and cultural considerations.

Personalized Wealth Management Plans

Multi Family Offices work closely with each client to understand their financial objectives, risk tolerance, and long-term goals. By gathering this information, the Multi Family Office can create a customized wealth management plan that includes investment strategies, estate planning, tax optimization, and other services tailored to the client's specific needs.

Final Review

In conclusion, the discussion surrounding How Multi Family Office Services Enable Global Wealth Control sheds light on the crucial role these entities play in ensuring financial stability and security for high-net-worth individuals across the globe.

FAQ Resource

How do Multi Family Offices differ from traditional wealth management firms?

Multi Family Offices offer personalized services tailored specifically to the needs of affluent families, whereas traditional wealth management firms may have a broader client base.

What are some common challenges faced by high-net-worth individuals in managing wealth globally?

High-net-worth individuals often encounter issues related to complex international regulations, tax implications, and the need for diversified investment strategies.

How do Multi Family Offices contribute to financial stability for their clients?

Multi Family Offices provide comprehensive wealth management solutions that aim to optimize financial resources, mitigate risks, and ensure long-term financial security for their clients.