Embarking on a journey through the realm of High Net Worth Advisors and Cross-Border Tax Planning unveils a landscape rich with opportunities and complexities. As we delve into the intricacies of financial planning for individuals with significant assets and explore the nuances of cross-border tax considerations, a tapestry of strategies and insights begins to emerge, guiding us towards a path of informed decision-making and wealth preservation.

Exploring the realm of international tax compliance and the strategies employed by high net worth individuals, this narrative aims to shed light on the multifaceted world of financial management in a global context.

High Net Worth Advisors

High net worth advisors play a crucial role in assisting individuals with significant assets in managing their finances effectively. These professionals provide personalized financial planning and investment advice tailored to the unique needs and goals of high net worth clients.Benefits of Working with High Net Worth Advisors

- Customized Financial Strategies: High net worth advisors create personalized financial plans that align with the client's long-term objectives and risk tolerance.

- Specialized Knowledge: These advisors possess expertise in managing complex financial situations, such as tax planning, estate planning, and wealth preservation.

- Access to Exclusive Opportunities: High net worth advisors often have access to exclusive investment opportunities and networks that can benefit their clients.

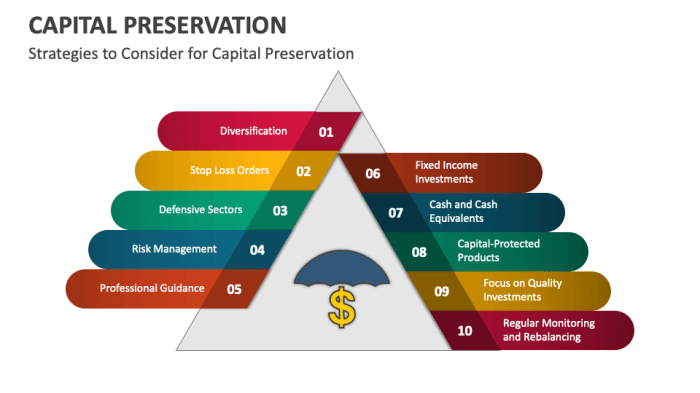

- Risk Management: Advisors help clients mitigate risks and protect their wealth through diversification and strategic investment decisions.

Qualifications and Certifications for High Net Worth Advisors

To become a high net worth advisor, individuals typically need to obtain relevant certifications such as Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Chartered Wealth Manager (CWM). Additionally, a strong educational background in finance, economics, or a related field is essential to excel in this role.Strategies Used by High Net Worth Advisors

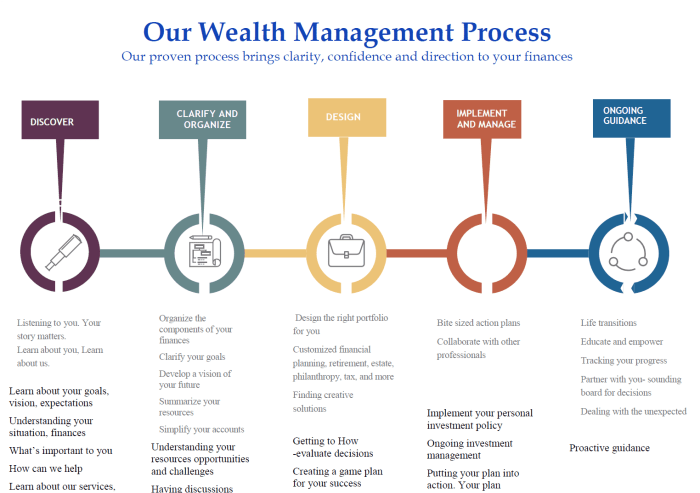

Asset Allocation:High net worth advisors employ asset allocation strategies to optimize the client's investment portfolio based on their risk tolerance and financial goals.

Tax Planning:Advisors help clients minimize tax liabilities through strategic tax planning strategies, including tax-efficient investment vehicles and estate planning techniques.

Estate Planning:High net worth advisors assist clients in creating comprehensive estate plans to ensure the smooth transfer of wealth to future generations while minimizing tax implications.

Risk Management:Advisors implement risk management techniques to protect the client's assets from market volatility and unforeseen events, ensuring long-term financial security.

Cross-Border Tax Planning

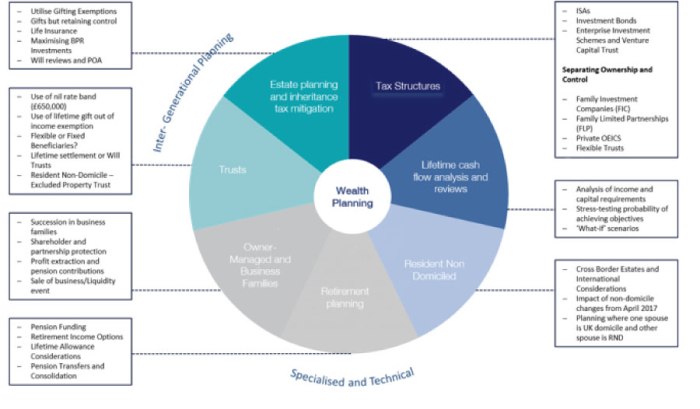

Cross-border tax planning refers to the strategies and mechanisms put in place to optimize tax efficiency for individuals with financial interests in multiple countries. This area of financial planning is crucial for high net worth individuals who have assets, investments, or income streams across borders. By carefully strategizing and managing their taxes, these individuals can minimize their tax liabilities and maximize their wealth preservation.Complexities of Cross-Border Tax Planning

Cross-border tax planning involves navigating the tax laws, regulations, and treaties of multiple countries, which can be significantly more complex than dealing with domestic tax planning. Different countries have varying tax rates, rules for residency, treatment of income, and reporting requirements, making it challenging to ensure compliance and optimize tax outcomes. Additionally, currency exchange rates, foreign tax credits, and double taxation issues further complicate the planning process.Challenges and Strategies for Advisors

Advisors specializing in cross-border tax planning face challenges such as staying updated on ever-changing tax laws, interpreting complex international tax treaties, and coordinating with tax authorities in different jurisdictions. To overcome these challenges, advisors leverage their expertise, networks, and technology tools to develop tailored tax strategies for their clients. They also collaborate with legal experts, accountants, and other professionals to ensure comprehensive and compliant planning.Considerations for High Net Worth Individuals

High net worth individuals engaging in cross-border tax planning must consider various factors to optimize their tax positions. These include determining tax residency status, understanding the implications of foreign investments, utilizing tax-efficient structures like trusts or holding companies, and leveraging tax treaties to prevent double taxation. Additionally, they need to stay informed about changes in tax laws and regulations that may impact their financial decisions and adjust their strategies accordingly.Strategies for High Net Worth Individuals

High net worth individuals often employ various tax planning strategies to minimize their tax liabilities and maximize their wealth. These strategies can include utilizing different investment vehicles, estate planning, and philanthropy to achieve tax efficiency and financial goals.

Common Tax Planning Strategies

- Utilizing tax-deferred retirement accounts to reduce taxable income.

- Investing in tax-exempt municipal bonds to generate tax-free income.

- Implementing tax-loss harvesting to offset capital gains with capital losses.

- Setting up family trusts and gifting strategies to transfer wealth tax-efficiently.

Comparison of Investment Vehicles

High net worth individuals often prefer investment vehicles such as:

- Private equity and venture capital funds for higher returns and potential tax benefits.

- Real estate investments for depreciation deductions and capital gain treatment.

- Tax-efficient index funds and ETFs to minimize capital gains taxes.

Importance of Estate Planning

Estate planning is crucial for high net worth individuals to ensure that their wealth is passed on to future generations efficiently and in line with their wishes. It involves strategies like:

- Setting up wills and trusts to minimize estate taxes and avoid probate.

- Utilizing life insurance policies to provide liquidity for estate taxes.

- Establishing family limited partnerships for asset protection and succession planning.

Role of Philanthropy in Tax Planning

Philanthropy plays a significant role in tax planning for high net worth individuals by allowing them to:

- Donate appreciated assets to charity to receive a tax deduction for the full market value.

- Establish charitable remainder trusts to generate income for themselves and donate the remainder to charity.

- Create private foundations to support charitable causes while receiving tax benefits.

International Tax Compliance

International tax compliance is a crucial aspect for high net worth individuals with assets and interests in multiple countries. It refers to the adherence to tax laws and regulations in different jurisdictions to ensure that individuals are fulfilling their tax obligations accordingly.Regulatory Requirements for High Net Worth Individuals

- High net worth individuals may be required to report their foreign financial accounts and assets to the tax authorities of their home country.

- They might also need to disclose their foreign income and pay taxes on any income generated outside their home country.

- Compliance with the Foreign Account Tax Compliance Act (FATCA) and Common Reporting Standard (CRS) are essential for high net worth individuals with international assets.

Role of Tax Treaties in Mitigating Double Taxation

- Tax treaties play a significant role in preventing double taxation for high net worth individuals with cross-border interests by providing rules for determining which country has the right to tax specific types of income.

- These treaties help avoid situations where the same income is taxed in more than one country, providing relief through mechanisms like tax credits or exemptions.

Penalties and Consequences of Non-Compliance

- Non-compliance with international tax regulations can result in severe penalties, including substantial fines, interest on unpaid taxes, and even criminal prosecution in some cases.

- High net worth individuals may also face reputational damage and the risk of losing access to international financial markets if found guilty of tax evasion or non-compliance.

Final Review

In conclusion, High Net Worth Advisors and Cross-Border Tax Planning represent not only crucial elements of financial stewardship but also gateways to safeguarding wealth and navigating the intricate landscape of international tax regulations. By understanding the roles, challenges, and strategies involved in these domains, individuals can embark on a journey towards financial security and tax efficiency, armed with knowledge and foresight.

Commonly Asked Questions

What are the qualifications needed to become a high net worth advisor?

To become a high net worth advisor, individuals typically need certifications such as Certified Financial Planner (CFP) and relevant experience in financial planning for affluent clients.

Why is estate planning important for high net worth individuals?

Estate planning is crucial for high net worth individuals as it helps in managing and transferring wealth efficiently, while also minimizing tax implications for future generations.

How do tax treaties help in mitigating double taxation for high net worth individuals?

Tax treaties establish agreements between countries to prevent the same income from being taxed twice, thus reducing the tax burden on high net worth individuals with cross-border interests.