How Money Wealth Management Supports Financial Independence sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

Effective wealth management plays a crucial role in achieving financial independence, encompassing budgeting, saving, and investing to secure a stable financial future.

Importance of Money Wealth Management

Effective money wealth management is crucial for achieving financial independence. It involves creating a plan to manage and grow your finances over time through budgeting, saving, and investing wisely. By implementing sound wealth management strategies, individuals can secure their financial future and reach their long-term goals.Budgeting

Budgeting plays a key role in money wealth management by helping individuals track their income and expenses. By creating a budget and sticking to it, individuals can prioritize their spending, save for the future, and avoid unnecessary debt. This disciplined approach to money management lays the foundation for building wealth over time.Saving

Saving is another essential component of wealth management. By setting aside a portion of income regularly, individuals can create an emergency fund, save for big purchases, and invest for the future. Saving money not only provides financial security but also allows for opportunities to grow wealth through smart investments.Investing

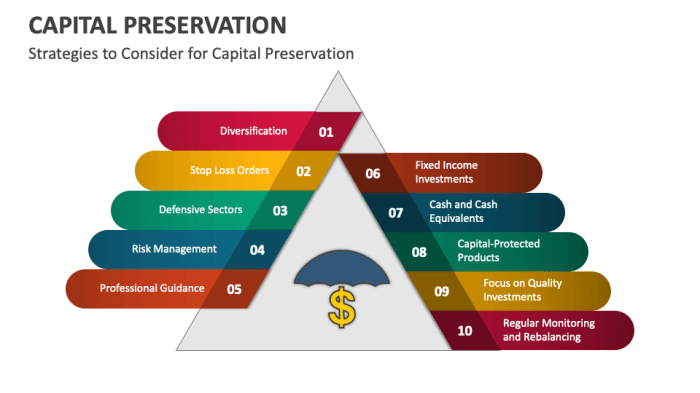

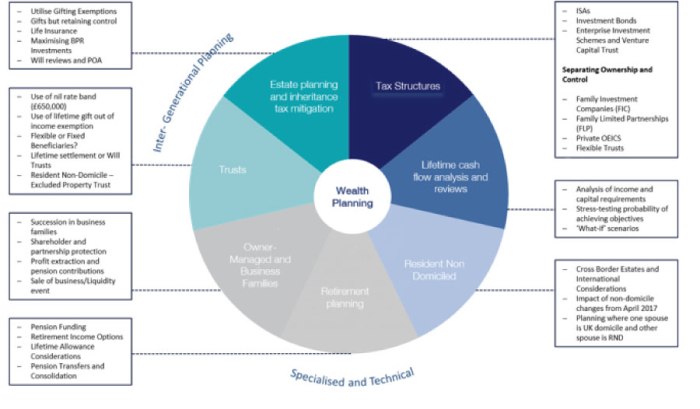

Investing is a powerful tool for wealth management, as it allows individuals to grow their money over time. By diversifying investments across different asset classes, individuals can mitigate risk and maximize returns. Investing in stocks, bonds, real estate, and other assets can help individuals build wealth and achieve financial independence in the long run.Strategies for Financial Independence

Achieving financial independence is a goal for many individuals, and effective money wealth management plays a crucial role in making this goal a reality. By implementing key strategies and making smart investment decisions, individuals can work towards building wealth and securing their financial future.

Achieving financial independence is a goal for many individuals, and effective money wealth management plays a crucial role in making this goal a reality. By implementing key strategies and making smart investment decisions, individuals can work towards building wealth and securing their financial future.Investment Options for Growing Wealth

When it comes to growing wealth, there are various investment options to consider. Some common options include:- Stocks: Investing in individual stocks or through mutual funds can provide opportunities for capital appreciation.

- Real Estate: Owning property can generate rental income and potential appreciation in value over time.

- Bonds: Investing in bonds can provide a steady stream of income through interest payments.

- Index Funds: These funds provide diversified exposure to a broad market index, reducing individual stock risk.

The Importance of Diversification

Diversification is a key strategy in money wealth management that involves spreading investments across different asset classes to reduce risk. By diversifying your portfolio, you can minimize the impact of any one investment underperforming or experiencing losses. This can help protect your wealth and ensure a more stable financial future. Remember, the old adage, "Don't put all your eggs in one basket," holds true when it comes to investing for financial independence.Role of Financial Advisors in Wealth Management

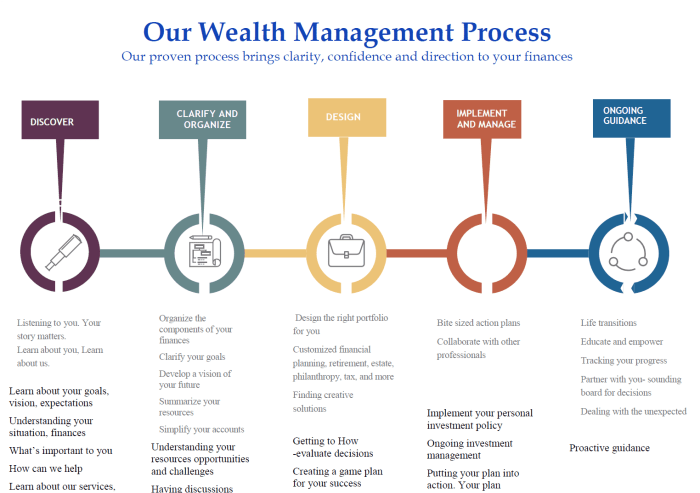

Financial advisors play a crucial role in helping individuals achieve financial independence by providing personalized guidance and strategies tailored to their specific financial goals and circumstances.Personalized Financial Plans

Financial advisors work closely with clients to assess their current financial situation, understand their short and long-term goals, and develop customized financial plans to help them achieve financial independence. These plans often include investment strategies, retirement planning, tax optimization, risk management, and estate planning.- Financial advisors conduct a comprehensive financial analysis to determine clients' risk tolerance, time horizon, and financial objectives.

- They create investment portfolios aligned with clients' goals and preferences, considering factors such as asset allocation, diversification, and investment performance.

- Financial advisors regularly review and adjust financial plans to accommodate changes in clients' circumstances, market conditions, or financial goals.

Benefits of Professional Advice

Seeking professional advice from financial advisors for wealth management offers numerous benefits, including:- Expertise: Financial advisors have the knowledge and expertise to help clients navigate complex financial decisions and optimize their wealth-building strategies.

- Objective Guidance: Financial advisors provide unbiased advice and recommendations tailored to clients' best interests, free from conflicts of interest.

- Time Savings: By outsourcing financial management to advisors, individuals can save time and focus on their careers, families, or other pursuits while professionals handle their financial affairs.

- Peace of Mind: Knowing that their financial future is in capable hands, clients can enjoy peace of mind and confidence in their financial decisions.

Building Long-Term Wealth

Building long-term wealth requires a strategic plan that adapts to changing circumstances and goals over time. By setting financial goals and milestones, individuals can track their progress and make necessary adjustments to stay on course towards financial independence.Tips on Creating a Long-Term Wealth Management Plan

- Start by assessing your current financial situation, including income, expenses, assets, and liabilities.

- Define your long-term financial goals, such as retirement, homeownership, or education expenses.

- Create a budget and savings plan to allocate funds towards achieving these goals.

- Diversify your investments to mitigate risk and maximize returns over the long term.

- Regularly review and adjust your plan as needed to accommodate changes in income, expenses, or goals.

Significance of Setting Financial Goals and Milestones

- Financial goals provide a roadmap for your wealth management plan, giving you a clear direction to work towards.

- Milestones help you track your progress and celebrate achievements along the way, motivating you to stay on course.

- Setting specific, measurable, achievable, relevant, and time-bound (SMART) goals ensures clarity and accountability in your financial journey.

- By breaking down larger goals into smaller milestones, you can make steady progress towards long-term wealth accumulation.

Importance of Adjusting Financial Strategies as Life Circumstances Change

- Life is unpredictable, and circumstances such as job changes, family events, or economic shifts can impact your financial situation.

- Regularly reviewing and adjusting your financial strategies allows you to adapt to these changes and stay aligned with your long-term goals.

- Flexibility in your wealth management plan enables you to seize opportunities, navigate challenges, and maintain financial stability over the years.

- Consulting with a financial advisor can provide valuable insights and guidance on adjusting your strategies to optimize your wealth-building efforts.

Last Point

In conclusion, understanding how money wealth management supports financial independence is key to building a secure financial foundation for the future. By implementing key strategies and seeking professional advice, individuals can pave the way towards long-term wealth and financial stability.

Essential FAQs

What is money wealth management?

Money wealth management involves effectively managing one's finances through budgeting, saving, and investing to achieve financial goals and independence.

Why is diversification important in investment portfolios?

Diversification helps spread risk across different asset classes, reducing the impact of market fluctuations on a portfolio's overall performance.

How do financial advisors help with wealth management?

Financial advisors provide personalized financial plans, offer insights on investment options, and guide individuals in making informed decisions for long-term wealth growth.