Delve into the world of wealth management with PWM Finance and discover how it plays a crucial role in the transfer of generational wealth. This engaging introduction sets the stage for a journey filled with insights and strategies to secure your family's financial future.

Exploring the nuances of PWM Finance and its impact on generational wealth transfer, this paragraph offers a glimpse into a realm where financial stability meets long-term planning.

Introduction to PWM Finance

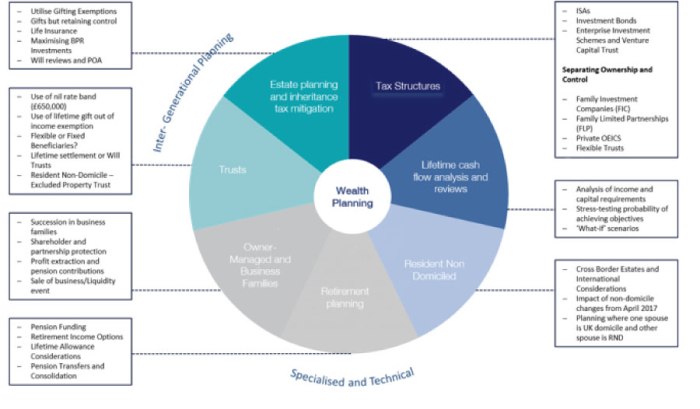

PWM Finance, also known as Private Wealth Management, is a specialized financial service that caters to high-net-worth individuals and families. It focuses on managing and growing their wealth through personalized strategies tailored to their specific financial goals and needs.Significance of PWM Finance in Wealth Management

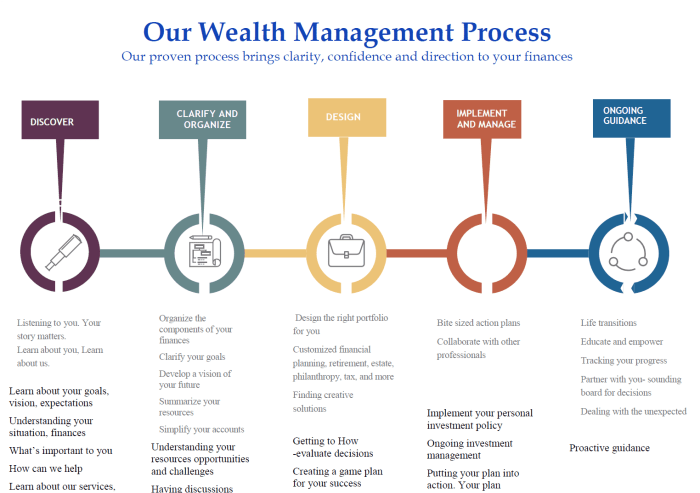

PWM Finance plays a crucial role in wealth management by providing customized solutions that go beyond traditional financial management services. This includes in-depth financial planning, investment advice, tax planning, estate planning, and risk management, all designed to preserve and grow wealth for future generations.Key Differences from Traditional Financial Management

Unlike traditional financial management, PWM Finance offers a more comprehensive approach that takes into account the unique circumstances and objectives of affluent clients. This personalized service goes beyond standard investment advice to encompass a holistic wealth management strategy that considers long-term financial goals and intergenerational wealth transfer.Role of PWM Finance in Long-Term Financial Planning

PWM Finance is instrumental in long-term financial planning as it helps high-net-worth individuals and families create a roadmap for the preservation and transfer of wealth across generations. By addressing complex financial needs and goals, PWM Finance ensures that wealth is managed efficiently and effectively to sustain and enhance financial legacies for the future.Importance of Generational Wealth Transfer

Generational wealth transfer is a crucial aspect of financial planning that involves passing down assets, property, and resources from one generation to the next. It plays a significant role in ensuring the long-term financial security and stability of families.

Challenges Associated with Transferring Wealth Across Generations

- Complex Family Dynamics: Inheritance can sometimes lead to conflicts and disputes among family members, especially when there is ambiguity or lack of communication regarding the transfer of wealth.

- Tax Implications: Transferring wealth can trigger tax liabilities, which may reduce the overall value of the assets being passed down.

- Economic Changes: Economic fluctuations and market uncertainties can impact the value of inherited assets, affecting the financial well-being of future generations.

Benefits of Establishing a Solid Strategy for Generational Wealth Transfer

- Financial Security: By carefully planning and managing the transfer of wealth, families can ensure that future generations have the resources they need to achieve their financial goals.

- Legacy Preservation: Establishing a solid strategy for wealth transfer allows families to preserve their values, traditions, and legacy for generations to come.

- Asset Protection: Proper planning can help protect assets from creditors, lawsuits, and other risks, safeguarding the wealth for the benefit of heirs and beneficiaries.

How PWM Finance Facilitates Generational Wealth Transfer

Specific Tools and Strategies Used in PWM Finance for Wealth Transfer

- Trust and Estate Planning: PWM Finance helps clients establish trusts and develop comprehensive estate plans to protect assets and ensure their smooth transfer to heirs.

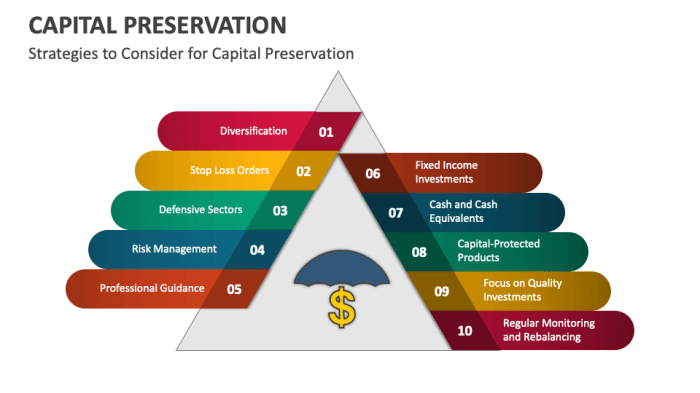

- Asset Allocation: By strategically allocating assets across different investment vehicles, PWM Finance advisors aim to maximize returns and preserve wealth for future generations.

- Tax Optimization Strategies: PWM Finance professionals work to minimize tax liabilities through efficient tax planning, allowing families to pass on more of their wealth to beneficiaries.

Role of Financial Advisors in Facilitating Generational Wealth Transfer

- Customized Advice: Financial advisors at PWM Finance provide personalized guidance tailored to the unique financial goals and circumstances of each client, ensuring that wealth transfer strategies align with their objectives.

- Educational Support: Advisors educate clients on the importance of generational wealth transfer and empower them to make informed decisions that will benefit future generations.

- Monitoring and Adjustments: PWM Finance advisors continuously monitor the performance of wealth transfer strategies and make adjustments as needed to maximize outcomes and adapt to changing circumstances.

Examples of Successful Cases where PWM Finance has Supported Generational Wealth Transfer

- Case Study 1: A high-net-worth family successfully transferred their wealth to the next generation through a combination of trust planning and tax optimization strategies recommended by their PWM Finance advisor, minimizing tax implications and ensuring a smooth transition of assets.

- Case Study 2: By diversifying their investment portfolio with guidance from PWM Finance professionals, a family was able to preserve and grow their wealth over multiple generations, securing a solid financial foundation for their heirs.

Building a Legacy through PWM Finance

Preserving and growing family wealth for future generations is a key aspect of building a legacy, and PWM Finance plays a crucial role in this process.

Importance of Education and Communication

Education and communication are vital components in ensuring a smooth wealth transfer process. By educating family members on financial literacy and the importance of long-term planning, PWM Finance helps lay the foundation for a successful legacy.

Leveraging Investment Opportunities

One of the ways PWM Finance facilitates generational wealth transfer is by leveraging investment opportunities for long-term wealth preservation. By carefully strategizing and diversifying investments, families can secure their financial future and create a lasting legacy for generations to come.

Closing Notes

As we conclude our discussion on how PWM Finance supports generational wealth transfer, we reflect on the importance of strategic planning and financial education for securing a lasting legacy. Dive into the world of wealth management with confidence and pave the way for a prosperous future for generations to come.

Q&A

How can PWM Finance help in transferring wealth across generations?

PWM Finance utilizes specific tools and strategies tailored for wealth transfer, ensuring a smooth transition of assets from one generation to the next.

What role do financial advisors play in generational wealth transfer through PWM Finance?

Financial advisors provide expertise and guidance in developing a solid strategy for generational wealth transfer, maximizing the benefits for future heirs.

Delve into the world of wealth management with PWM Finance and discover how it plays a crucial role in the transfer of generational wealth. This engaging introduction sets the stage for a journey filled with insights and strategies to secure your family's financial future.

Exploring the nuances of PWM Finance and its impact on generational wealth transfer, this paragraph offers a glimpse into a realm where financial stability meets long-term planning.

Introduction to PWM Finance

PWM Finance, also known as Private Wealth Management, is a specialized financial service that caters to high-net-worth individuals and families. It focuses on managing and growing their wealth through personalized strategies tailored to their specific financial goals and needs.Significance of PWM Finance in Wealth Management

PWM Finance plays a crucial role in wealth management by providing customized solutions that go beyond traditional financial management services. This includes in-depth financial planning, investment advice, tax planning, estate planning, and risk management, all designed to preserve and grow wealth for future generations.Key Differences from Traditional Financial Management

Unlike traditional financial management, PWM Finance offers a more comprehensive approach that takes into account the unique circumstances and objectives of affluent clients. This personalized service goes beyond standard investment advice to encompass a holistic wealth management strategy that considers long-term financial goals and intergenerational wealth transfer.Role of PWM Finance in Long-Term Financial Planning

PWM Finance is instrumental in long-term financial planning as it helps high-net-worth individuals and families create a roadmap for the preservation and transfer of wealth across generations. By addressing complex financial needs and goals, PWM Finance ensures that wealth is managed efficiently and effectively to sustain and enhance financial legacies for the future.Importance of Generational Wealth Transfer

Generational wealth transfer is a crucial aspect of financial planning that involves passing down assets, property, and resources from one generation to the next. It plays a significant role in ensuring the long-term financial security and stability of families.

Challenges Associated with Transferring Wealth Across Generations

- Complex Family Dynamics: Inheritance can sometimes lead to conflicts and disputes among family members, especially when there is ambiguity or lack of communication regarding the transfer of wealth.

- Tax Implications: Transferring wealth can trigger tax liabilities, which may reduce the overall value of the assets being passed down.

- Economic Changes: Economic fluctuations and market uncertainties can impact the value of inherited assets, affecting the financial well-being of future generations.

Benefits of Establishing a Solid Strategy for Generational Wealth Transfer

- Financial Security: By carefully planning and managing the transfer of wealth, families can ensure that future generations have the resources they need to achieve their financial goals.

- Legacy Preservation: Establishing a solid strategy for wealth transfer allows families to preserve their values, traditions, and legacy for generations to come.

- Asset Protection: Proper planning can help protect assets from creditors, lawsuits, and other risks, safeguarding the wealth for the benefit of heirs and beneficiaries.

How PWM Finance Facilitates Generational Wealth Transfer

Specific Tools and Strategies Used in PWM Finance for Wealth Transfer

- Trust and Estate Planning: PWM Finance helps clients establish trusts and develop comprehensive estate plans to protect assets and ensure their smooth transfer to heirs.

- Asset Allocation: By strategically allocating assets across different investment vehicles, PWM Finance advisors aim to maximize returns and preserve wealth for future generations.

- Tax Optimization Strategies: PWM Finance professionals work to minimize tax liabilities through efficient tax planning, allowing families to pass on more of their wealth to beneficiaries.

Role of Financial Advisors in Facilitating Generational Wealth Transfer

- Customized Advice: Financial advisors at PWM Finance provide personalized guidance tailored to the unique financial goals and circumstances of each client, ensuring that wealth transfer strategies align with their objectives.

- Educational Support: Advisors educate clients on the importance of generational wealth transfer and empower them to make informed decisions that will benefit future generations.

- Monitoring and Adjustments: PWM Finance advisors continuously monitor the performance of wealth transfer strategies and make adjustments as needed to maximize outcomes and adapt to changing circumstances.

Examples of Successful Cases where PWM Finance has Supported Generational Wealth Transfer

- Case Study 1: A high-net-worth family successfully transferred their wealth to the next generation through a combination of trust planning and tax optimization strategies recommended by their PWM Finance advisor, minimizing tax implications and ensuring a smooth transition of assets.

- Case Study 2: By diversifying their investment portfolio with guidance from PWM Finance professionals, a family was able to preserve and grow their wealth over multiple generations, securing a solid financial foundation for their heirs.

Building a Legacy through PWM Finance

Preserving and growing family wealth for future generations is a key aspect of building a legacy, and PWM Finance plays a crucial role in this process.

Importance of Education and Communication

Education and communication are vital components in ensuring a smooth wealth transfer process. By educating family members on financial literacy and the importance of long-term planning, PWM Finance helps lay the foundation for a successful legacy.

Leveraging Investment Opportunities

One of the ways PWM Finance facilitates generational wealth transfer is by leveraging investment opportunities for long-term wealth preservation. By carefully strategizing and diversifying investments, families can secure their financial future and create a lasting legacy for generations to come.

Closing Notes

As we conclude our discussion on how PWM Finance supports generational wealth transfer, we reflect on the importance of strategic planning and financial education for securing a lasting legacy. Dive into the world of wealth management with confidence and pave the way for a prosperous future for generations to come.

Q&A

How can PWM Finance help in transferring wealth across generations?

PWM Finance utilizes specific tools and strategies tailored for wealth transfer, ensuring a smooth transition of assets from one generation to the next.

What role do financial advisors play in generational wealth transfer through PWM Finance?

Financial advisors provide expertise and guidance in developing a solid strategy for generational wealth transfer, maximizing the benefits for future heirs.