Embarking on the journey of understanding how wealth management advisors near you build client trust unveils a world of tailored services, personal relationships, transparency, and expertise. This narrative delves into the intricacies of this vital process, shedding light on the strategies that forge lasting connections between advisors and their clients.

As we delve deeper into the realm of wealth management, we discover the key elements that shape the foundation of trust in financial advisory relationships.

Understanding Client Needs

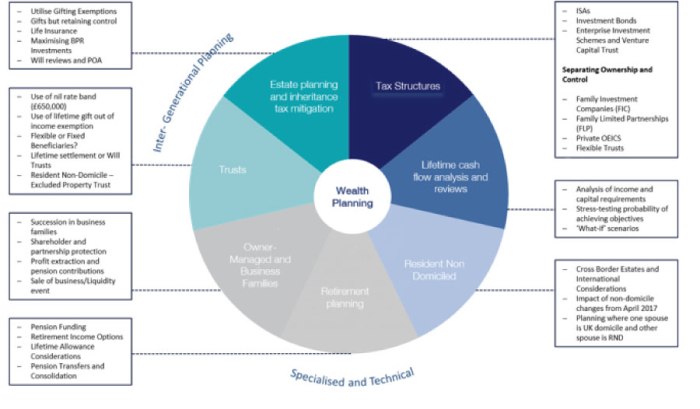

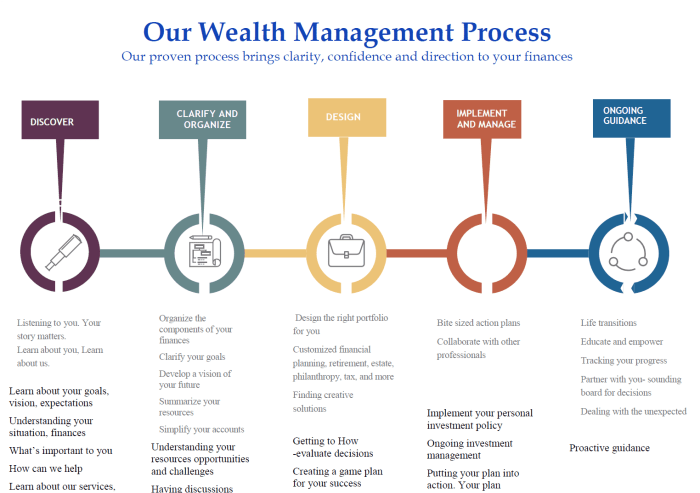

Understanding the unique financial needs of clients is crucial for wealth management advisors to provide personalized and effective services. By tailoring their approach to meet individual client requirements, advisors can build trust and establish long-term relationships.Assessing Client Needs

Wealth management advisors use various strategies to assess the financial needs of their clients effectively. Some common approaches include:- Conducting thorough interviews to understand clients' financial goals, risk tolerance, and investment preferences.

- Reviewing clients' financial documents, such as tax returns, investment statements, and estate planning documents.

- Utilizing financial planning tools and questionnaires to gather important information about clients' current financial situation and future objectives.

- Collaborating with other professionals, such as accountants and estate attorneys, to gain a comprehensive understanding of clients' overall financial picture.

Building Personal Relationships

Building personal relationships with clients is crucial for wealth management advisors as it helps in establishing trust and rapport. By getting to know clients on a personal level, advisors can better understand their needs, preferences, and financial goals.Methods to Establish Trust and Rapport

- Active Listening: Advisors actively listen to clients without interrupting, showing empathy and understanding.

- Open Communication: Keeping clients informed and involved in the decision-making process fosters trust.

- Transparency: Being transparent about fees, risks, and potential outcomes builds credibility.

- Consistent Follow-Up: Regular check-ins and updates demonstrate commitment and care for clients' financial well-being.

Personalizing Client Interactions

- Understanding Individual Goals: Advisors tailor their advice and strategies based on each client's unique financial objectives.

- Preferred Communication Style: Some clients may prefer phone calls, while others may prefer emails or in-person meetings. Advisors adapt to these preferences.

- Remembering Personal Details: Acknowledging birthdays, anniversaries, or other significant events shows clients that advisors value them beyond just their financial assets.

Transparency and Communication

Transparency plays a crucial role in building trust between wealth management advisors and their clients. By being open and honest about their processes, fees, and potential conflicts of interest, advisors establish a foundation of trust that is essential for a successful client-advisor relationship. Clients are more likely to feel confident in their advisor's recommendations when they believe that the information they are receiving is transparent and reliable.

Transparency plays a crucial role in building trust between wealth management advisors and their clients. By being open and honest about their processes, fees, and potential conflicts of interest, advisors establish a foundation of trust that is essential for a successful client-advisor relationship. Clients are more likely to feel confident in their advisor's recommendations when they believe that the information they are receiving is transparent and reliable.Effective Communication Strategies

Effective communication is key for wealth management advisors to build and maintain trust with their clients- Active listening: Advisors listen attentively to their clients' needs and concerns, ensuring that they fully understand their financial goals.

- Clear and concise explanations: Advisors communicate complex financial information in a way that is easy for clients to understand, avoiding jargon or technical terms.

- Regular updates: Advisors provide regular updates on the performance of their clients' investments and any changes in the market that may impact their financial plans.

- Accessibility: Advisors make themselves available to clients for any questions or concerns, whether through in-person meetings, phone calls, or emails.

Open and Honest Communication Channels

Wealth management advisors maintain open and honest communication channels with their clients by:- Setting clear expectations: Advisors establish communication protocols with their clients from the beginning, outlining how often they will provide updates and what information will be shared.

- Being proactive: Advisors reach out to clients regularly, not just when there are major updates or changes in their financial situation, to maintain a consistent dialogue.

- Addressing concerns promptly: Advisors respond to client inquiries or concerns in a timely manner, showing that they prioritize their clients' needs and are committed to providing excellent service.

- Using multiple communication channels: Advisors adapt to their clients' preferences by utilizing various communication channels such as phone calls, emails, video calls, or in-person meetings to ensure accessibility and convenience.

Expertise and Credibility

In the wealth management industry, expertise and credibility play a crucial role in building trust with clients. Clients look for advisors who have in-depth knowledge and experience in managing finances effectively. Demonstrating expertise and credibility helps advisors establish a strong relationship with their clients based on trust and confidence.

In the wealth management industry, expertise and credibility play a crucial role in building trust with clients. Clients look for advisors who have in-depth knowledge and experience in managing finances effectively. Demonstrating expertise and credibility helps advisors establish a strong relationship with their clients based on trust and confidence.Examples of Demonstrating Knowledge and Expertise

- Providing personalized financial plans tailored to the client's specific goals and needs.

- Offering investment strategies based on thorough market research and analysis.

- Sharing success stories and case studies of how previous clients have achieved their financial goals under the advisor's guidance.

- Attending industry conferences, workshops, and seminars to stay updated on the latest trends and regulations in wealth management.

Role of Certifications and Qualifications

- Obtaining certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) showcases the advisor's commitment to professional development and adherence to ethical standards.

- Clients often value advisors with recognized qualifications as it demonstrates a certain level of expertise and credibility in the field.

- Continuing education and staying abreast of industry changes are essential to maintaining certifications and qualifications, reinforcing the advisor's credibility over time.

Last Word

In conclusion, the art of building trust between wealth management advisors and their clients is a multifaceted process that involves understanding, personalization, transparency, and credibility. By incorporating these elements into their practice, advisors can create strong and lasting bonds with those they serve.

FAQ Guide

How do wealth management advisors assess client needs effectively?

Advisors use a variety of strategies such as in-depth consultations, financial assessments, and risk tolerance evaluations to ensure they understand the unique financial needs of each client.

What methods do advisors use to establish rapport with clients?

Advisors often build rapport through active listening, empathy, and personalized communication to create a sense of trust and connection with their clients.

How do wealth management advisors maintain open communication channels with clients?

Advisors maintain open communication channels by providing regular updates, being available for questions, and ensuring transparency in all financial dealings.

What role do certifications and qualifications play in establishing credibility for advisors?

Certifications and qualifications showcase an advisor's expertise and knowledge in the wealth management industry, helping to establish trust and credibility with clients.