Delving into the realm of wealth planning services and financial transparency, this article sets the stage for a deep dive into the intricacies of how transparency plays a pivotal role in shaping financial decisions. Prepare to uncover the hidden gems that lie within the world of wealth planning.

Exploring the various facets and nuances of transparency in wealth planning services, this piece aims to shed light on the importance of clear communication, regulatory compliance, and innovative tools that drive financial transparency forward.

The Importance of Financial Transparency in Wealth Planning Services

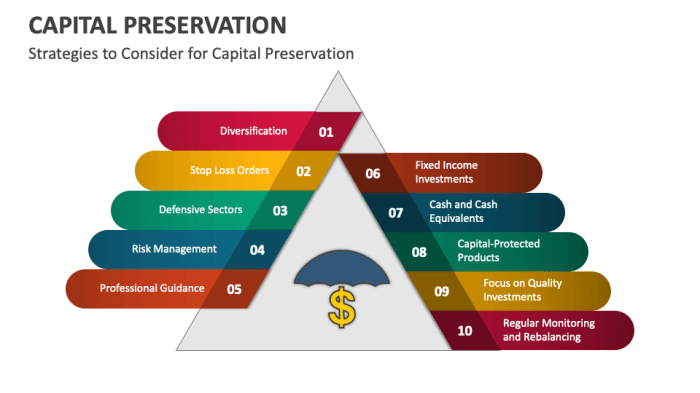

Financial transparency plays a crucial role in wealth planning services as it helps clients make informed decisions about their financial future. By providing clarity and openness in financial matters, transparency enhances trust between clients and wealth planners, leading to more successful financial planning outcomes.

Financial transparency plays a crucial role in wealth planning services as it helps clients make informed decisions about their financial future. By providing clarity and openness in financial matters, transparency enhances trust between clients and wealth planners, leading to more successful financial planning outcomes.Benefits of Financial Transparency:

- Clear Understanding: Transparent communication ensures that clients fully understand their financial situation and the strategies being implemented.

- Improved Decision-Making: With access to all relevant information, clients can make well-informed decisions that align with their goals and values.

- Increased Accountability: Transparency holds wealth planners accountable for their advice and recommendations, promoting ethical behavior and responsible financial management.

Role of Transparency in Trust Building:

Transparency builds trust by demonstrating honesty, integrity, and a commitment to putting clients' best interests first.Clients feel more secure when they have a clear view of their financial status and the actions taken on their behalf by wealth planners. This trust forms the foundation for a strong and lasting client-advisor relationship.

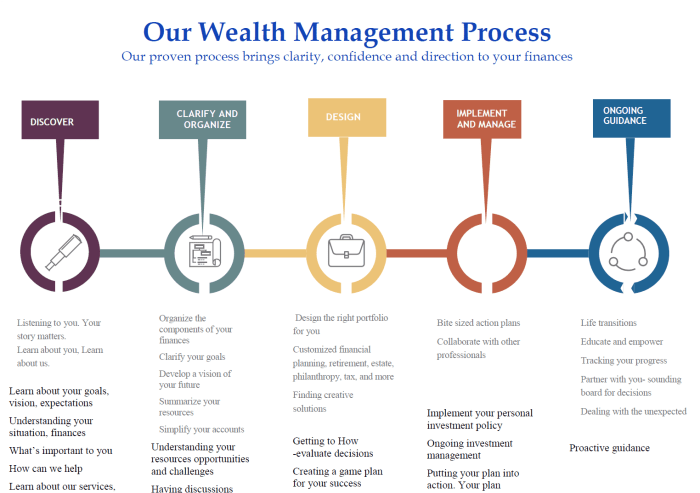

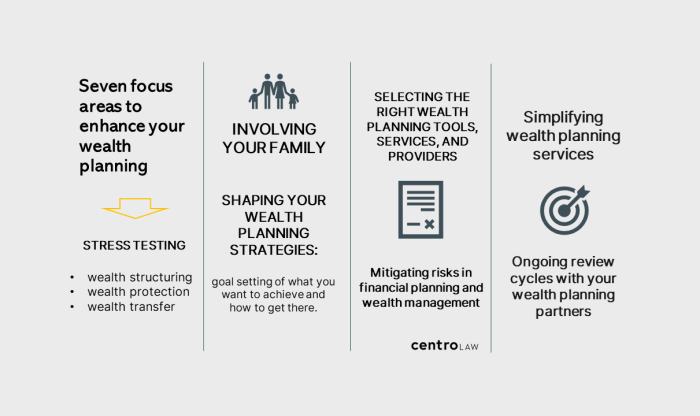

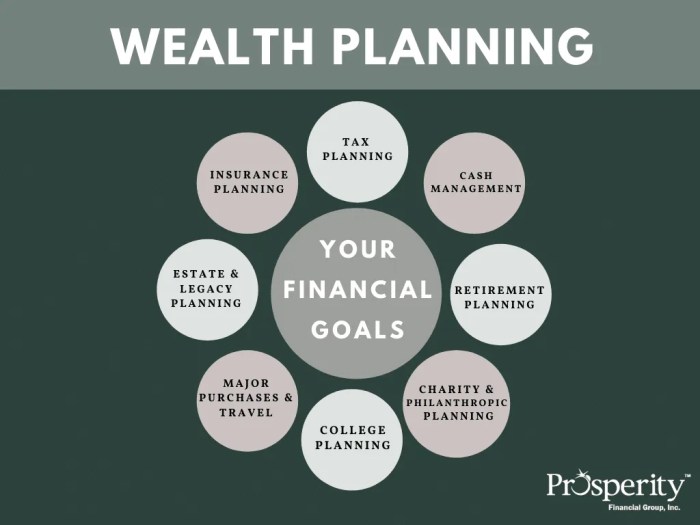

Tools and Strategies for Enhancing Financial Transparency

Financial transparency in wealth planning services can be enhanced through the utilization of specific tools and strategies. These resources play a crucial role in providing clients with a clear understanding of their financial situation and helping them make informed decisions.

Key Tools for Enhancing Financial Transparency

- Financial Aggregation Tools: These tools gather all financial information in one place, allowing advisors and clients to view a comprehensive picture of assets, liabilities, and cash flow.

- Portfolio Management Software: This software enables real-time tracking of investments, performance analysis, and risk assessment, providing transparency on investment strategies and outcomes.

- Financial Planning Software: By inputting data such as income, expenses, and goals, this software can generate detailed financial plans, helping clients understand their current financial position and future projections.

Role of Technology in Improving Transparency

Technology plays a vital role in enhancing financial transparency in wealth planning services. With the advancements in digital tools and software, advisors can access real-time data, perform complex analyses, and communicate effectively with clients, fostering a transparent and collaborative relationship.

Best Practices for Promoting Transparency

- Regular Client Communication: Maintaining open and frequent communication with clients helps build trust and ensures that they are informed about their financial status and any changes in their wealth plan.

- Educational Workshops and Seminars: Hosting educational events to explain financial concepts, investment strategies, and market trends can empower clients to make well-informed decisions and understand the reasoning behind recommendations.

- Clear Fee Structures: Transparent fee structures and disclosures regarding compensation help clients understand the costs associated with wealth planning services and the value they receive in return.

Communication Practices for Transparent Wealth Planning

Effective communication between clients and wealth planners is crucial for ensuring transparency in wealth planning services. Clear and open dialogue can significantly enhance financial transparency and build trust between all parties involved.Regular Updates and Progress Reports

- Regular updates on investment performance, market trends, and financial goals help clients stay informed about their wealth management strategies.

- Progress reports detailing the status of portfolios and any changes made provide transparency regarding the actions taken by wealth planners.

Active Listening and Understanding Client Needs

- Wealth planners need to actively listen to clients' concerns, goals, and preferences to tailor financial strategies accordingly.

- Understanding client needs fosters trust and ensures that wealth planning decisions align with the clients' best interests.

Accessibility and Availability

- Being accessible to clients and promptly addressing their inquiries or requests promotes transparency and demonstrates a commitment to client satisfaction.

- Availability for meetings, calls, or emails helps in clarifying any financial matters and maintaining open communication channels.

Education and Explanation

- Providing educational resources and explanations about complex financial concepts empowers clients to make informed decisions and understand the rationale behind wealth planning strategies.

- Clear explanations about fees, risks, and potential outcomes ensure that clients have a comprehensive understanding of their financial situation.

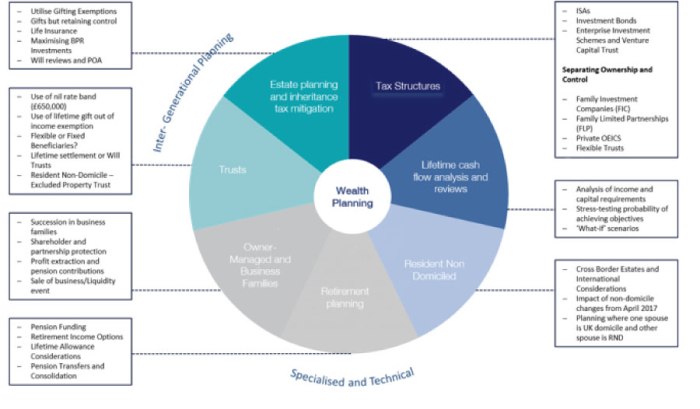

Regulatory Compliance and Financial Transparency

Ensuring regulatory compliance is a crucial aspect of maintaining financial transparency in wealth planning services. Various regulations govern the disclosure of financial information to clients and stakeholders, aiming to promote accountability and trust.

Regulations Governing Financial Transparency

Financial transparency in wealth planning services is often regulated by government authorities and industry-specific organizations. For example, in the United States, the Securities and Exchange Commission (SEC) imposes strict rules on investment advisors and financial planners regarding the disclosure of fees, conflicts of interest, and investment strategies.

- Adherence to the Investment Advisers Act of 1940

- Compliance with the Financial Industry Regulatory Authority (FINRA) rules

- Following the guidelines set by the Certified Financial Planner Board of Standards

Implications of Non-Compliance

Failure to comply with transparency regulations can lead to severe consequences for wealth planning firms and individual advisors. Non-compliance may result in legal penalties, fines, reputational damage, and loss of clients' trust. Moreover, it can undermine the credibility and integrity of the entire financial services industry.

Non-compliance with transparency regulations can jeopardize the long-term success and sustainability of wealth planning practices.

Enhancing Trust and Transparency through Regulatory Compliance

By adhering to regulatory requirements, wealth planning services can build trust with their clients and stakeholders. Compliance demonstrates a commitment to ethical conduct, responsible practices, and putting the clients' interests first. Transparent communication about regulatory compliance can reassure clients and enhance the overall credibility of wealth planning professionals.

Final Wrap-Up

In conclusion, the journey through how wealth planning services enhance financial transparency unveils a landscape where trust, communication, and compliance intersect to create a secure foundation for robust financial planning. With transparency as the guiding principle, clients and wealth planners forge a path towards financial clarity and confidence.

FAQ Summary

How can financial transparency benefit clients in wealth planning services?

Financial transparency can empower clients by providing a clear understanding of their financial situation, enabling informed decision-making and fostering trust with their wealth planners.

What role does technology play in enhancing financial transparency in wealth planning services?

Technology serves as a catalyst for improved transparency by offering tools like financial tracking software, secure communication platforms, and data analytics that streamline information sharing and enhance client-advisor interactions.

Why is open dialogue crucial for ensuring transparency in wealth planning?

Open dialogue fosters trust, clarifies expectations, and ensures that both clients and wealth planners are on the same page regarding financial goals, strategies, and outcomes, ultimately enhancing transparency throughout the planning process.