Diving into how wealth planning services support family-owned businesses, this introduction sets the stage for an insightful exploration of the topic.

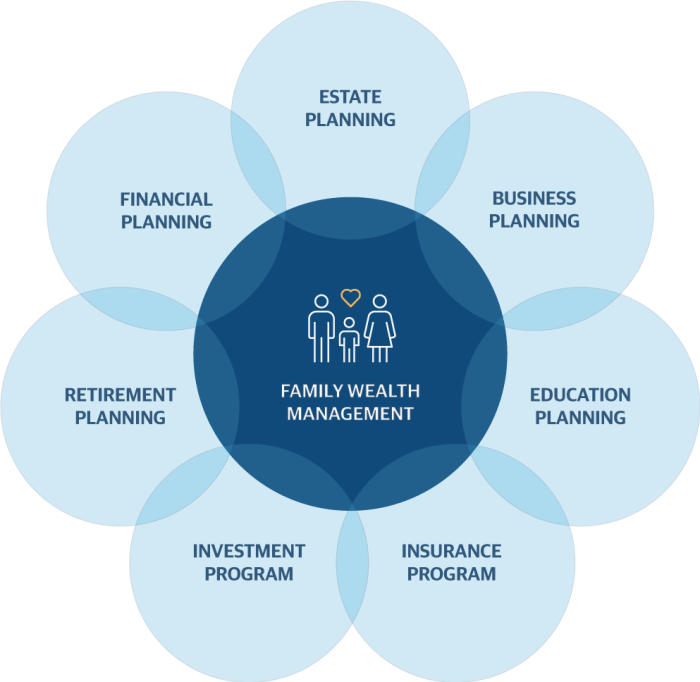

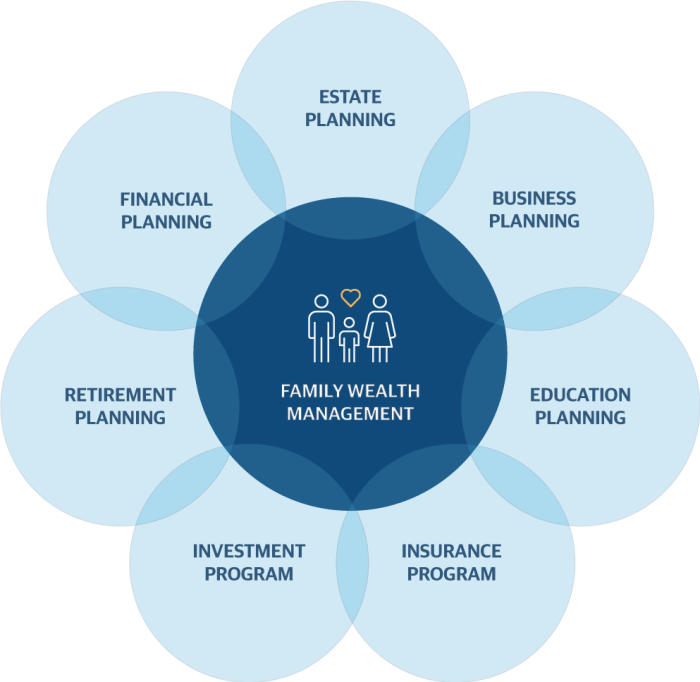

We will delve into the importance of wealth planning services in ensuring the continuity and growth of family businesses, customized financial strategies, wealth protection, risk management, succession planning, and wealth transfer.

Importance of Wealth Planning Services for Family-Owned Businesses

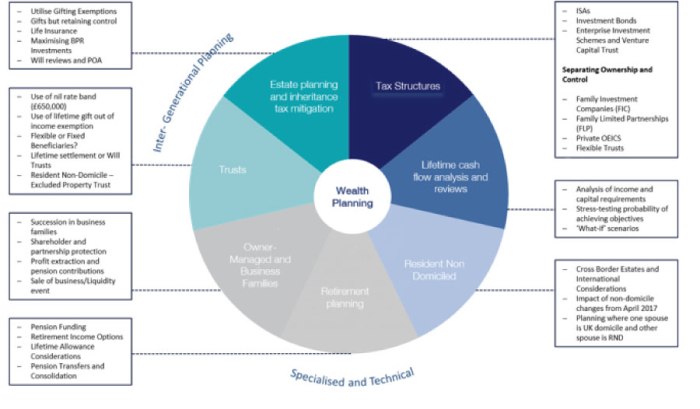

Wealth planning services play a crucial role in supporting the success and sustainability of family-owned businesses. These services offer specialized financial advice and strategies tailored to the unique needs and goals of family enterprises.Ensuring Business Continuity

Wealth planning services help family-owned businesses develop succession plans to ensure a smooth transition of ownership and management from one generation to the next. By creating a comprehensive strategy, these services can minimize potential conflicts among family members and maintain the continuity of the business.Facilitating Growth Opportunities

Through effective wealth planning, family-owned businesses can identify growth opportunities and allocate resources strategically. Wealth planners can assist in optimizing the business structure, managing risks, and capitalizing on market trends to enhance the overall growth and profitability of the enterprise.Addressing Tax and Legal Challenges

Family-owned businesses often face complex tax and legal challenges due to their unique ownership structure. Wealth planning services can help businesses navigate these challenges by providing tax-efficient strategies, asset protection solutions, and compliance with regulatory requirements. By proactively addressing these issues, family businesses can minimize risks and maximize their financial stability.Preserving Family Wealth

Wealth planning services also focus on preserving and growing family wealth for future generations. By implementing effective wealth transfer strategies, such as trusts or estate planning, these services help families protect their assets and ensure a secure financial legacy for heirs. This long-term perspective is essential for the sustainability of family-owned businesses over time.Tailored Financial Strategies for Family-Owned Businesses

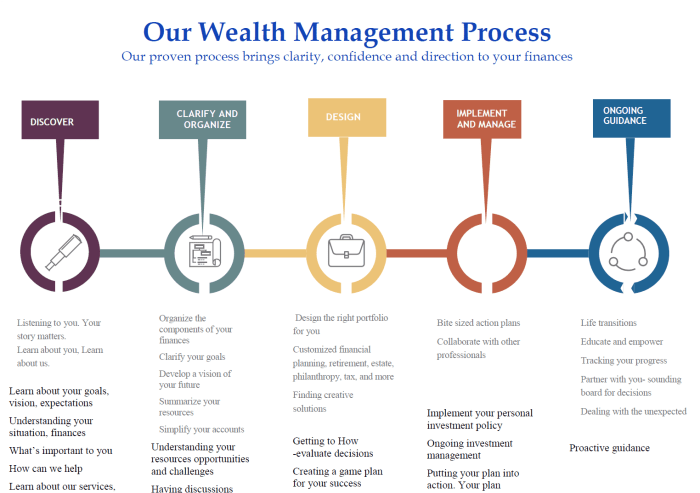

Tailored financial strategies are essential for the success and sustainability of family-owned businesses. Wealth planning services play a crucial role in creating customized financial plans that align with the unique values and vision of the family business.

Tailored financial strategies are essential for the success and sustainability of family-owned businesses. Wealth planning services play a crucial role in creating customized financial plans that align with the unique values and vision of the family business.Customized Financial Strategies

Wealth planning services work closely with family-owned businesses to understand their specific financial needs and goals. By tailoring financial strategies to meet these requirements, advisors can help businesses optimize their financial performance and achieve long-term success.- Creating a comprehensive financial plan that considers both short-term and long-term objectives.

- Implementing tax-efficient strategies to maximize wealth preservation and minimize tax liabilities.

- Developing investment portfolios that align with the risk tolerance and investment preferences of the family business.

- Establishing contingency plans to mitigate risks and ensure business continuity in case of unforeseen events.

Alignment with Values and Vision

One of the key aspects of tailored financial strategies for family-owned businesses is the alignment with the values and vision of the business owners. Wealth planning services take into account the family's unique goals, priorities, and aspirations to create a financial plan that reflects these core principles.By aligning financial goals with the values and vision of the family business, wealth planning services help ensure that the business remains true to its founding principles and long-term objectives.

Succession Planning and Growth Support

Wealth planning services also play a vital role in supporting family-owned businesses in succession planning and growth initiatives. By developing strategies that facilitate smooth transitions of leadership and ownership, advisors help businesses navigate generational changes and ensure continuity of operations.- Implementing estate planning strategies to transfer wealth efficiently to future generations.

- Creating buy-sell agreements to facilitate the transfer of ownership in the event of retirement, disability, or death.

- Assisting in the development of growth strategies, such as expanding into new markets or diversifying revenue streams.

- Providing guidance on financing options for expansion projects or acquisitions.

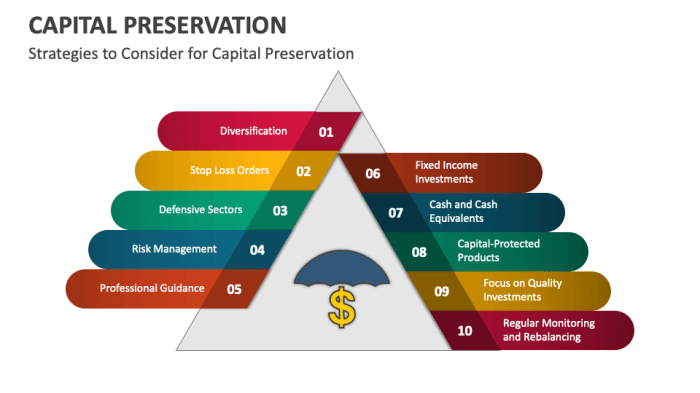

Wealth Protection and Risk Management

Family-owned businesses face unique challenges when it comes to wealth protection and risk management. Wealth planning services play a crucial role in helping these businesses safeguard their assets and navigate potential risks effectively.

Asset Protection Strategies

- Creating a trust structure: Wealth planning services can assist family-owned businesses in setting up trusts to protect assets from creditors or legal claims.

- Insurance coverage: Implementing comprehensive insurance policies can help mitigate financial losses in case of unexpected events like natural disasters or lawsuits.

- Legal entity protection: Structuring the business as a limited liability company (LLC) or corporation can provide a layer of protection for personal assets of the business owners.

Risk Management Techniques

- Diversification of investments: Wealth planning services recommend spreading investments across different asset classes to reduce the impact of market fluctuations on the business's overall wealth.

- Contingency planning: Developing contingency plans for potential risks such as economic downturns, changes in regulations, or loss of key personnel can help family businesses stay resilient in challenging times.

- Regular risk assessments: Conducting periodic risk assessments with the help of wealth planners can identify vulnerabilities and opportunities for improvement in risk management strategies.

Succession Planning and Wealth Transfer

Succession planning is a crucial aspect for family-owned businesses to ensure a smooth transition of ownership and management from one generation to the next. Wealth planning services play a vital role in facilitating this process by providing expertise in creating tailored strategies that address the unique challenges faced by family businesses.Significance of Succession Planning

Succession planning is essential for family-owned businesses to maintain continuity, preserve wealth, and secure the future of the business. Wealth planning services help in identifying potential successors, establishing clear roles and responsibilities, and implementing tax-efficient strategies to transfer assets seamlessly.

Challenges of Wealth Transfer

One of the main challenges of wealth transfer within family businesses is managing conflicts and expectations among family members. Wealth planning services can assist in navigating these complexities by creating governance structures, establishing communication protocols, and developing fair distribution plans to minimize disputes.

Successful Wealth Transfer Strategies

- Implementing a family charter or constitution to Artikel values, vision, and decision-making processes for the business.

- Utilizing trusts or family limited partnerships to transfer assets while maintaining control over the business.

- Creating a buy-sell agreement to address succession in the event of unforeseen circumstances or disagreements among family members.

- Engaging in regular family meetings facilitated by wealth planning experts to foster open communication and alignment on long-term goals.

Last Recap

In conclusion, wealth planning services play a crucial role in supporting the long-term success and sustainability of family-owned businesses. By addressing key challenges and providing tailored financial solutions, these services help secure the future of these enterprises.

FAQ Compilation

How can wealth planning services help in ensuring the continuity of family businesses?

Wealth planning services can assist in creating financial strategies that align with the values and vision of the family business, ensuring a smooth transition and sustainable growth.

What are some examples of risk management strategies used by wealth planning services for family-owned businesses?

Wealth planning services often implement diversification of assets, insurance coverage, and contingency plans to protect family businesses from unforeseen risks.

Why is succession planning crucial for family-owned businesses?

Succession planning ensures a smooth transfer of wealth and leadership within the family business, maintaining continuity and stability for future generations.

Diving into how wealth planning services support family-owned businesses, this introduction sets the stage for an insightful exploration of the topic.

We will delve into the importance of wealth planning services in ensuring the continuity and growth of family businesses, customized financial strategies, wealth protection, risk management, succession planning, and wealth transfer.

Importance of Wealth Planning Services for Family-Owned Businesses

Wealth planning services play a crucial role in supporting the success and sustainability of family-owned businesses. These services offer specialized financial advice and strategies tailored to the unique needs and goals of family enterprises.Ensuring Business Continuity

Wealth planning services help family-owned businesses develop succession plans to ensure a smooth transition of ownership and management from one generation to the next. By creating a comprehensive strategy, these services can minimize potential conflicts among family members and maintain the continuity of the business.Facilitating Growth Opportunities

Through effective wealth planning, family-owned businesses can identify growth opportunities and allocate resources strategically. Wealth planners can assist in optimizing the business structure, managing risks, and capitalizing on market trends to enhance the overall growth and profitability of the enterprise.Addressing Tax and Legal Challenges

Family-owned businesses often face complex tax and legal challenges due to their unique ownership structure. Wealth planning services can help businesses navigate these challenges by providing tax-efficient strategies, asset protection solutions, and compliance with regulatory requirements. By proactively addressing these issues, family businesses can minimize risks and maximize their financial stability.Preserving Family Wealth

Wealth planning services also focus on preserving and growing family wealth for future generations. By implementing effective wealth transfer strategies, such as trusts or estate planning, these services help families protect their assets and ensure a secure financial legacy for heirs. This long-term perspective is essential for the sustainability of family-owned businesses over time.Tailored Financial Strategies for Family-Owned Businesses

Tailored financial strategies are essential for the success and sustainability of family-owned businesses. Wealth planning services play a crucial role in creating customized financial plans that align with the unique values and vision of the family business.

Tailored financial strategies are essential for the success and sustainability of family-owned businesses. Wealth planning services play a crucial role in creating customized financial plans that align with the unique values and vision of the family business.Customized Financial Strategies

Wealth planning services work closely with family-owned businesses to understand their specific financial needs and goals. By tailoring financial strategies to meet these requirements, advisors can help businesses optimize their financial performance and achieve long-term success.- Creating a comprehensive financial plan that considers both short-term and long-term objectives.

- Implementing tax-efficient strategies to maximize wealth preservation and minimize tax liabilities.

- Developing investment portfolios that align with the risk tolerance and investment preferences of the family business.

- Establishing contingency plans to mitigate risks and ensure business continuity in case of unforeseen events.

Alignment with Values and Vision

One of the key aspects of tailored financial strategies for family-owned businesses is the alignment with the values and vision of the business owners. Wealth planning services take into account the family's unique goals, priorities, and aspirations to create a financial plan that reflects these core principles.By aligning financial goals with the values and vision of the family business, wealth planning services help ensure that the business remains true to its founding principles and long-term objectives.

Succession Planning and Growth Support

Wealth planning services also play a vital role in supporting family-owned businesses in succession planning and growth initiatives. By developing strategies that facilitate smooth transitions of leadership and ownership, advisors help businesses navigate generational changes and ensure continuity of operations.- Implementing estate planning strategies to transfer wealth efficiently to future generations.

- Creating buy-sell agreements to facilitate the transfer of ownership in the event of retirement, disability, or death.

- Assisting in the development of growth strategies, such as expanding into new markets or diversifying revenue streams.

- Providing guidance on financing options for expansion projects or acquisitions.

Wealth Protection and Risk Management

Family-owned businesses face unique challenges when it comes to wealth protection and risk management. Wealth planning services play a crucial role in helping these businesses safeguard their assets and navigate potential risks effectively.

Asset Protection Strategies

- Creating a trust structure: Wealth planning services can assist family-owned businesses in setting up trusts to protect assets from creditors or legal claims.

- Insurance coverage: Implementing comprehensive insurance policies can help mitigate financial losses in case of unexpected events like natural disasters or lawsuits.

- Legal entity protection: Structuring the business as a limited liability company (LLC) or corporation can provide a layer of protection for personal assets of the business owners.

Risk Management Techniques

- Diversification of investments: Wealth planning services recommend spreading investments across different asset classes to reduce the impact of market fluctuations on the business's overall wealth.

- Contingency planning: Developing contingency plans for potential risks such as economic downturns, changes in regulations, or loss of key personnel can help family businesses stay resilient in challenging times.

- Regular risk assessments: Conducting periodic risk assessments with the help of wealth planners can identify vulnerabilities and opportunities for improvement in risk management strategies.

Succession Planning and Wealth Transfer

Succession planning is a crucial aspect for family-owned businesses to ensure a smooth transition of ownership and management from one generation to the next. Wealth planning services play a vital role in facilitating this process by providing expertise in creating tailored strategies that address the unique challenges faced by family businesses.Significance of Succession Planning

Succession planning is essential for family-owned businesses to maintain continuity, preserve wealth, and secure the future of the business. Wealth planning services help in identifying potential successors, establishing clear roles and responsibilities, and implementing tax-efficient strategies to transfer assets seamlessly.

Challenges of Wealth Transfer

One of the main challenges of wealth transfer within family businesses is managing conflicts and expectations among family members. Wealth planning services can assist in navigating these complexities by creating governance structures, establishing communication protocols, and developing fair distribution plans to minimize disputes.

Successful Wealth Transfer Strategies

- Implementing a family charter or constitution to Artikel values, vision, and decision-making processes for the business.

- Utilizing trusts or family limited partnerships to transfer assets while maintaining control over the business.

- Creating a buy-sell agreement to address succession in the event of unforeseen circumstances or disagreements among family members.

- Engaging in regular family meetings facilitated by wealth planning experts to foster open communication and alignment on long-term goals.

Last Recap

In conclusion, wealth planning services play a crucial role in supporting the long-term success and sustainability of family-owned businesses. By addressing key challenges and providing tailored financial solutions, these services help secure the future of these enterprises.

FAQ Compilation

How can wealth planning services help in ensuring the continuity of family businesses?

Wealth planning services can assist in creating financial strategies that align with the values and vision of the family business, ensuring a smooth transition and sustainable growth.

What are some examples of risk management strategies used by wealth planning services for family-owned businesses?

Wealth planning services often implement diversification of assets, insurance coverage, and contingency plans to protect family businesses from unforeseen risks.

Why is succession planning crucial for family-owned businesses?

Succession planning ensures a smooth transfer of wealth and leadership within the family business, maintaining continuity and stability for future generations.