Money Wealth Management for Multinational Investors sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. In today's interconnected world, managing wealth across borders poses unique challenges that require strategic solutions.

Importance of Money Wealth Management for Multinational Investors

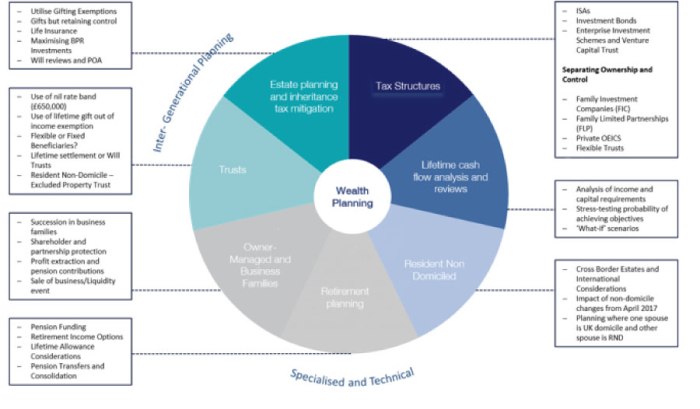

Effective money wealth management is crucial for multinational investors due to the unique challenges they face in managing their wealth across different countries. These challenges can include varying tax laws, currency fluctuations, political instability, and differing regulatory environments.

Effective money wealth management is crucial for multinational investors due to the unique challenges they face in managing their wealth across different countries. These challenges can include varying tax laws, currency fluctuations, political instability, and differing regulatory environments.Managing Risks and Maximizing Returns

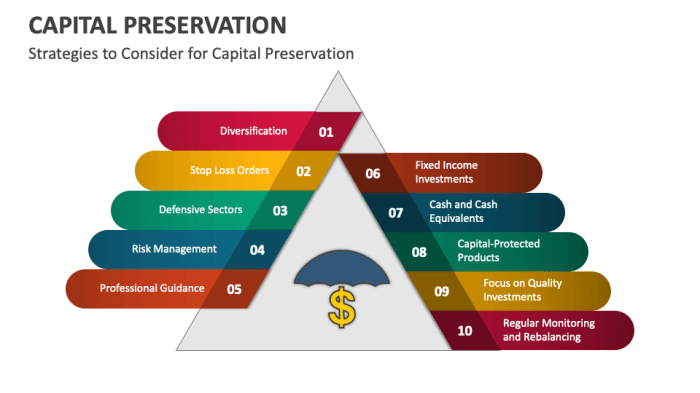

- Effective wealth management helps multinational investors mitigate risks associated with investing in multiple countries. By diversifying their portfolios and employing strategies to hedge against currency fluctuations, investors can protect their wealth from unforeseen events.

- Maximizing returns is also a key goal of wealth management for multinational investors. By carefully monitoring and adjusting their investments based on market conditions in different countries, investors can capitalize on opportunities for growth and profitability.

Consequences of Poor Wealth Management

- Poor wealth management can lead to significant financial losses for multinational investors. For example, failing to properly hedge against currency fluctuations can result in reduced returns or even losses on investments made in foreign markets.

- Additionally, inadequate risk management strategies can expose investors to unforeseen events such as economic downturns or political instability, leading to substantial losses in their investment portfolios.

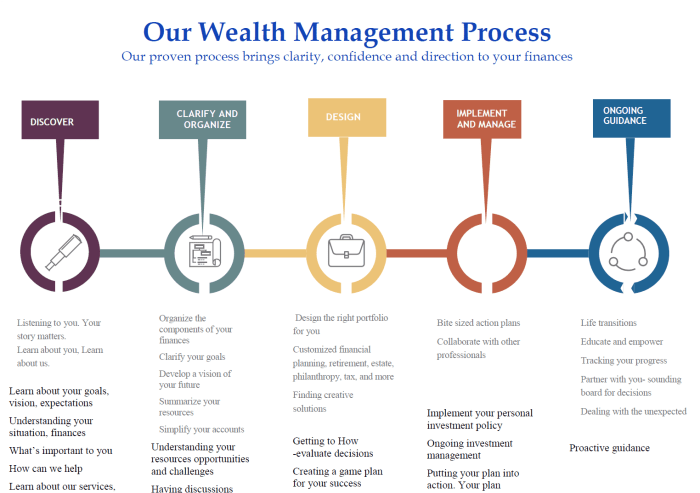

Strategies for Money Wealth Management for Multinational Investors

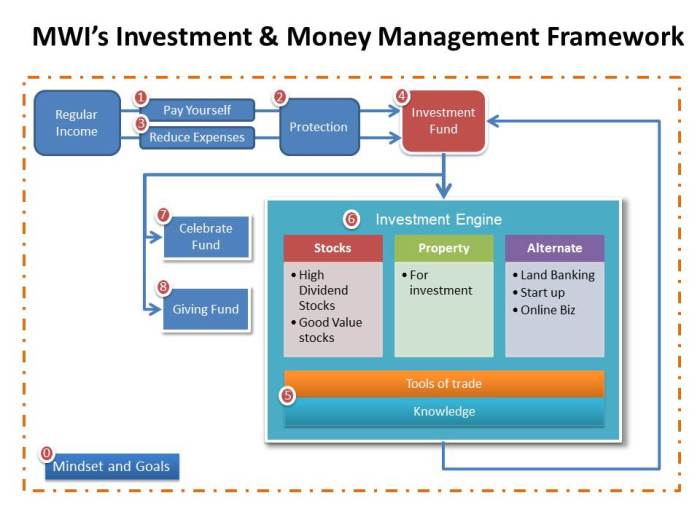

When it comes to managing wealth as a multinational investor, there are several key strategies that can help minimize risks and maximize returns. One of the main challenges for multinational investors is diversifying investments across multiple countries, each with its own unique economic and political landscape. In addition, tax planning plays a crucial role in wealth management for multinational investors, as different countries have varying tax laws that can significantly impact investment returns. Lastly, currency exchange fluctuations can have a major impact on wealth management decisions for multinational investors, affecting the value of investments and overall portfolio performance.Diversifying Investments

Diversification is a key strategy for multinational investors to reduce risk in their portfolios. By spreading investments across different countries and industries, investors can mitigate the impact of economic downturns or political instability in any one region. This can involve investing in a mix of stocks, bonds, real estate, and other assets in various countries to create a well-balanced portfolio.Tax Planning

Effective tax planning is essential for multinational investors to optimize their after-tax returns. This involves taking advantage of tax-efficient investment vehicles, utilizing tax treaties between countries, and strategically timing capital gains and losses to minimize tax liabilities. Working with tax advisors and professionals can help investors navigate the complex tax implications of investing across borders.Currency Exchange Fluctuations

Currency exchange fluctuations can significantly impact the value of investments for multinational investors. When investing in foreign assets, changes in exchange rates can either boost or erode investment returns. Investors need to consider currency risk and implement hedging strategies to protect their portfolios from adverse movements in exchange rates. Monitoring global economic trends and geopolitical events can help investors make informed decisions to manage currency risk effectively.Tools and Technologies for Money Wealth Management for Multinational Investors

In today's digital age, multinational investors have access to a wide range of tools and technologies that can help them effectively manage their wealth across borders. These innovative financial technologies not only streamline the investment process but also provide valuable insights and analytics to make informed decisions.Innovative Financial Technologies for Money Wealth Management

- Digital Portfolio Management Platforms: These platforms offer a centralized dashboard to track investments, monitor performance, and analyze risks across various asset classes and geographic locations.

- Robo-Advisors: Automated investment platforms that use algorithms to create and manage investment portfolios based on individual risk tolerance and financial goals.

- Blockchain Technology: Utilized for secure and transparent transactions, blockchain can enhance the efficiency and security of cross-border investments for multinational investors.

Comparison between Traditional and Digital Wealth Management Tools

- Traditional Tools: Manual spreadsheets and paper-based reports are being replaced by digital platforms that offer real-time updates and personalized insights.

- Digital Platforms: These platforms provide on-the-go access to investment data, interactive tools for financial planning, and automated rebalancing for optimized portfolios.

Importance of Cybersecurity Measures

- Secure Data Encryption: Implementing encryption protocols can safeguard sensitive financial information from unauthorized access or cyber threats.

- Multi-Factor Authentication: Adding an extra layer of security with multi-factor authentication can prevent unauthorized logins and protect investor accounts.

- Regular Security Audits: Conducting routine security audits and updates can mitigate vulnerabilities and ensure the protection of financial data stored on digital platforms.

Ethical Considerations in Money Wealth Management for Multinational Investors

Multinational investors often face ethical dilemmas when managing their wealth in different jurisdictions. These dilemmas can arise due to conflicting regulations, cultural differences, and varying ethical standards across countries. It is crucial for multinational investors to navigate these challenges while upholding ethical principles in their wealth management practices.Ethical Dilemmas in Wealth Management

- One common ethical dilemma is the issue of tax avoidance versus tax evasion. While minimizing tax liabilities is a legitimate practice, crossing the line into illegal tax evasion can have serious ethical and legal implications.

- Another dilemma is the use of offshore accounts and tax havens to shelter wealth from taxation. While these practices may be legal, they can raise ethical concerns about transparency and contributing to the local economy.

- Investing in industries with questionable ethical practices, such as weapons manufacturing or child labor, can also pose ethical dilemmas for multinational investors.

Role of Socially Responsible Investing

- Socially responsible investing (SRI) has emerged as a way for multinational investors to align their wealth management practices with their ethical values. SRI focuses on investing in companies that adhere to environmental, social, and governance (ESG) criteria.

- By incorporating SRI principles into their investment strategies, multinational investors can promote ethical business practices, support sustainable development, and mitigate risks associated with unethical behavior.

Transparency and Compliance with International Regulations

- Ensuring transparency and compliance with international regulations is essential for multinational investors to maintain ethical standards in wealth management. This includes accurately reporting financial information, adhering to anti-money laundering laws, and following ethical investment guidelines.

- By prioritizing transparency and compliance, multinational investors can build trust with stakeholders, demonstrate accountability, and mitigate reputational risks associated with unethical behavior.

End of Discussion

As we conclude our exploration of Money Wealth Management for Multinational Investors, it becomes evident that effective wealth management is not just about financial gains, but also about securing a stable future. By implementing key strategies and utilizing the right tools, investors can navigate the complexities of global finance with confidence and foresight.

FAQ Explained

What are the key challenges faced by multinational investors in managing their wealth across different countries?

Multinational investors often encounter issues related to varying tax regulations, currency exchange fluctuations, and cultural differences that can impact their wealth management decisions.

How can socially responsible investing play a role in wealth management practices for multinational investors?

Socially responsible investing allows multinational investors to align their financial goals with ethical considerations, promoting sustainability and positive social impact.

Why is compliance with international regulations crucial in wealth management for multinational investors?

Adhering to international regulations ensures transparency, accountability, and legal compliance, safeguarding investors' interests and reputation.