Embark on a journey through the realm of Multi Family Office Services for Complex Financial Structures, where expertise meets innovation to navigate intricate financial landscapes with precision and finesse.

Delve into the world of tailored financial solutions and comprehensive wealth management strategies that cater to the unique needs of high-net-worth families.

Definition of Multi Family Office Services for Complex Financial Structures

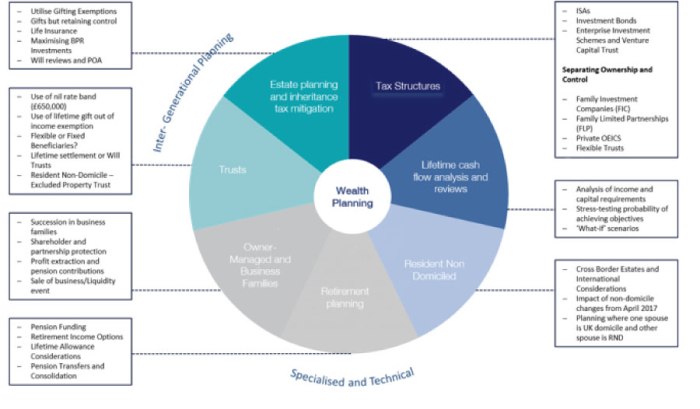

Multi family office services are tailored financial services that cater to the needs of high-net-worth individuals and families with complex financial structures. These services are designed to provide comprehensive wealth management solutions, including investment management, estate planning, tax optimization, and philanthropic strategies.

Multi family office services are tailored financial services that cater to the needs of high-net-worth individuals and families with complex financial structures. These services are designed to provide comprehensive wealth management solutions, including investment management, estate planning, tax optimization, and philanthropic strategies.Types of Services Offered by Multi Family Offices

- Investment Management: Multi family offices offer personalized investment strategies to help clients achieve their financial goals while managing risk.

- Estate Planning: These services include developing strategies to preserve and transfer wealth to future generations efficiently.

- Tax Optimization: Multi family offices help clients minimize their tax liabilities through strategic planning and compliance.

- Philanthropic Strategies: These services assist clients in creating and implementing charitable giving plans that align with their values and financial objectives.

Benefits of Utilizing Multi Family Office Services

- Customized Solutions: Multi family offices provide tailored solutions to meet the unique needs of each client's complex financial situation.

- Expertise and Experience: Clients benefit from the specialized knowledge and experience of professionals in various financial disciplines.

- Coordination and Integration: Multi family offices help coordinate and integrate various aspects of a client's financial life, ensuring a holistic approach to wealth management.

- Confidentiality and Privacy: Clients enjoy a high level of confidentiality and privacy when working with multi family offices, ensuring the protection of sensitive financial information.

Key Features of Multi Family Office Services

Multi family office services for complex financial structures offer a range of distinct features that set them apart from traditional wealth management firms. These services are tailored to meet the unique needs of high-net-worth families with intricate financial arrangements, providing specialized solutions and personalized attention.

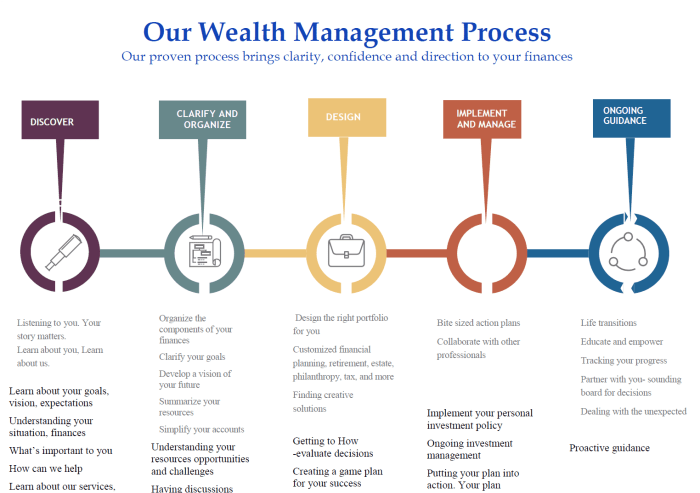

Comprehensive Financial Planning

Multi family offices provide comprehensive financial planning services that go beyond basic investment management. They take into account all aspects of a family's financial situation, including estate planning, tax optimization, risk management, and philanthropic initiatives.

Customized Wealth Management

Unlike traditional wealth management firms, multi family offices offer customized wealth management solutions tailored to the specific goals and preferences of each family. This personalized approach allows for greater flexibility and alignment with the family's long-term objectives.

Family Governance and Education

Multi family offices assist in establishing family governance structures to facilitate communication, decision-making, and succession planning across generations. They also provide financial education and guidance to help family members understand and manage their wealth effectively.

Access to Specialized Services

Multi family offices have access to a network of specialized professionals, including tax experts, legal advisors, and investment specialists. This enables them to offer a wide range of services under one roof, providing holistic solutions for complex financial structures.

Long-Term Relationship Focus

Multi family offices prioritize building long-term relationships with their clients, focusing on trust, confidentiality, and continuity of service. This approach fosters a deep understanding of the family's needs and allows for ongoing support and guidance over time.

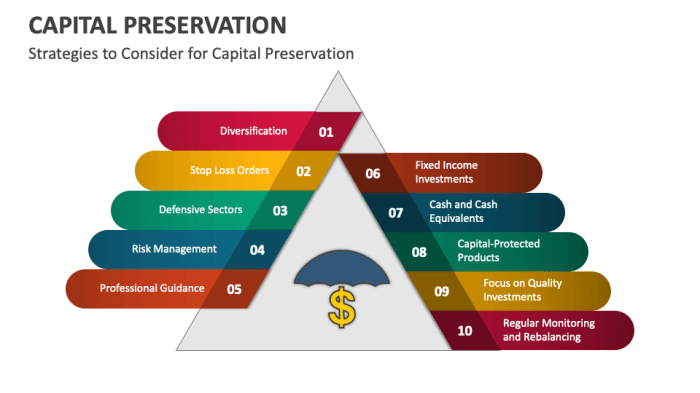

Investment Strategies and Wealth Management

When it comes to managing complex financial structures for high-net-worth families, multi family offices employ a variety of investment strategies to maximize returns and minimize risks. These strategies are tailored to the unique needs and goals of each client, taking into account factors such as risk tolerance, time horizon, and liquidity requirements.Investment Strategies

- Asset Allocation: Multi family offices create diversified portfolios by allocating assets across various classes such as stocks, bonds, real estate, and alternative investments.

- Active Management: They actively monitor and adjust portfolios to capitalize on market opportunities and mitigate potential risks.

- Alternative Investments: These include hedge funds, private equity, and venture capital, providing opportunities for higher returns and portfolio diversification.

- Impact Investing: Some multi family offices incorporate socially responsible investments to align with clients' values while generating positive social and environmental impact.

Wealth Management Integration

Multi family offices offer comprehensive wealth management services that go beyond investment management. They assist clients in areas such as estate planning, tax optimization, philanthropy, and generational wealth transfer. By integrating wealth management into their services, these offices provide holistic solutions to preserve and grow their clients' wealth over generations.Risk Management in Investment Portfolios

- Risk Assessment: Multi family offices conduct thorough risk assessments to understand clients' risk tolerance and financial goals, ensuring investment strategies align with their preferences.

- Diversification: By diversifying investments across different asset classes and regions, they reduce concentration risk and enhance portfolio resilience against market volatility.

- Monitoring and Rebalancing: Regular monitoring of portfolios allows for timely adjustments to maintain the desired risk-return profile and adapt to changing market conditions.

- Tailored Solutions: Customized risk management strategies are implemented to address specific client needs, such as hedging against currency fluctuations or interest rate risks.

Tax Planning and Compliance

Tax planning and compliance are crucial aspects of managing complex financial structures for high-net-worth families. Multi family offices play a significant role in helping clients navigate the intricate landscape of tax regulations and optimize their tax strategies to maximize wealth preservation.Tax Optimization Strategies

- Utilizing tax-efficient investment vehicles: Multi family offices can help high-net-worth families choose investment vehicles that offer tax benefits, such as tax-deferred accounts or municipal bonds.

- Implementing charitable giving strategies: By incorporating philanthropic endeavors into their financial plan, clients can benefit from tax deductions while supporting causes they care about.

- Strategic income shifting: Multi family offices can assist in redistributing income among family members to take advantage of lower tax brackets and reduce overall tax liability.

Importance of Tax Compliance

Staying compliant with tax laws and regulations is essential for high-net-worth families with complex financial structures to avoid potential penalties, fines, or legal issues. Multi family offices ensure that clients adhere to all tax requirements and meet deadlines to maintain financial stability and reputation.

End of Discussion

In conclusion, Multi Family Office Services offer a sophisticated approach to managing complex financial structures, ensuring optimal growth and protection for generations to come. Explore the possibilities and elevate your financial future with expert guidance and personalized solutions.

Detailed FAQs

What are the key benefits of Multi Family Office Services?

Multi Family Offices provide personalized financial solutions tailored to the specific needs of high-net-worth families, offering a comprehensive approach to wealth management and strategic financial planning.

How do Multi Family Offices differ from traditional wealth management firms?

Multi Family Offices focus on serving the unique requirements of affluent families with complex financial structures, offering a more personalized and holistic approach compared to traditional wealth management firms.

What investment strategies are commonly employed by Multi Family Offices?

Multi Family Offices often utilize a combination of traditional and alternative investment strategies to optimize returns and minimize risks for clients with intricate financial needs.

How do Multi Family Offices assist clients with tax planning and compliance?

Multi Family Offices provide tailored tax optimization strategies and ensure compliance with tax laws and regulations to help high-net-worth families navigate complex financial arrangements efficiently.

What role does risk management play in designing investment portfolios for clients with complex financial needs?

Risk management is essential in creating customized investment portfolios that align with the financial goals and risk tolerance of high-net-worth families, ensuring a balanced approach to wealth preservation and growth.