Embark on a journey through Private Wealth Management Near Me: A Complete Overview, delving into the intricacies of managing wealth effectively and locally. This comprehensive guide offers valuable insights into the world of private wealth management, shedding light on its importance and benefits for individuals seeking financial stability and growth.

As you explore the key components of private wealth management services and discover how to find reputable firms in your area, you'll gain a deeper understanding of how this specialized field can transform your financial future.

Introduction to Private Wealth Management

Private wealth management refers to the professional management of an individual's wealth and assets to achieve specific financial goals. It involves comprehensive financial planning, investment management, tax planning, estate planning, and other financial services tailored to meet the unique needs of high-net-worth individuals.The importance of private wealth management for individuals cannot be overstated. It provides a personalized approach to managing wealth, helping individuals grow and protect their assets over time. By working with experienced wealth managers, individuals can make informed financial decisions, mitigate risks, and maximize their wealth accumulation potential.

Private wealth management refers to the professional management of an individual's wealth and assets to achieve specific financial goals. It involves comprehensive financial planning, investment management, tax planning, estate planning, and other financial services tailored to meet the unique needs of high-net-worth individuals.The importance of private wealth management for individuals cannot be overstated. It provides a personalized approach to managing wealth, helping individuals grow and protect their assets over time. By working with experienced wealth managers, individuals can make informed financial decisions, mitigate risks, and maximize their wealth accumulation potential.Key Components of Private Wealth Management Services

- Financial Planning: Wealth managers create customized financial plans based on the individual's financial goals, risk tolerance, and time horizon.

- Investment Management: Wealth managers design investment portfolios aligned with the individual's objectives, diversification needs, and risk profile.

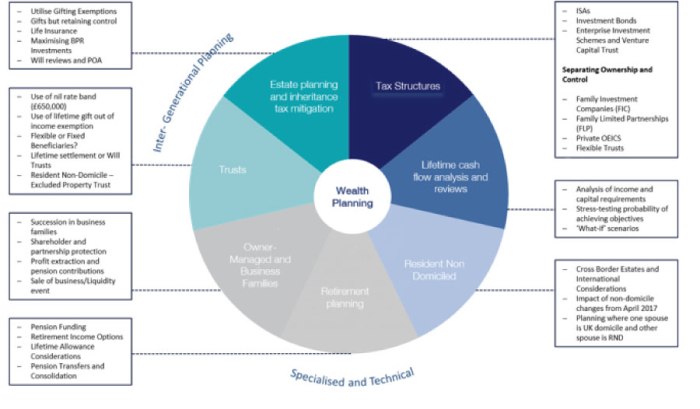

- Tax Planning: Wealth managers help minimize tax liabilities through efficient tax planning strategies and structures.

- Estate Planning: Wealth managers assist in developing estate plans to ensure the smooth transfer of assets to future generations while minimizing estate taxes.

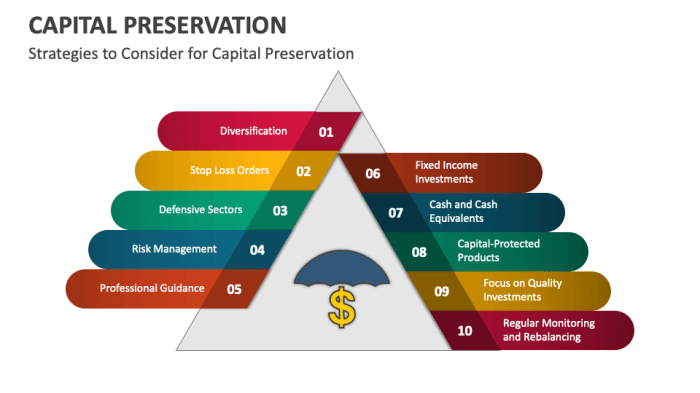

- Risk Management: Wealth managers analyze and manage risks associated with the individual's investments and overall financial situation.

Finding a Local Private Wealth Management Firm

When searching for a local private wealth management firm, there are several factors to consider to ensure you find the right fit for your financial needs.

Identify the factors to consider when looking for a local private wealth management firm:

- Reputation and Experience: Look for firms with a solid reputation and a proven track record of success in managing private wealth.

- Services Offered: Consider the specific services offered by the firm and whether they align with your financial goals and needs.

- Fee Structure: Understand the fee structure of the firm and ensure it is transparent and reasonable.

- Location and Accessibility: Choose a firm that is conveniently located and easily accessible for meetings and consultations.

- Client Reviews and Testimonials: Research client reviews and testimonials to gauge the satisfaction levels of current and past clients.

Discuss the benefits of choosing a nearby firm for private wealth management services:

- Convenience: Having a local wealth management firm makes it easier to schedule meetings and consultations without having to travel long distances.

- Personalized Service: Local firms may offer more personalized service and attention due to their proximity to clients.

- Knowledge of Local Market: A local firm may have a better understanding of the local market trends and opportunities, which can benefit your investment strategy.

List the ways to research and locate reputable private wealth management firms in your area:

- Ask for Recommendations: Seek recommendations from friends, family, or colleagues who have experience working with wealth management firms.

- Online Search: Use online resources and directories to search for local wealth management firms and read reviews from past clients.

- Attend Seminars and Workshops: Attend financial seminars and workshops in your area to network with professionals in the industry and learn more about local firms.

- Check Credentials: Verify the credentials and certifications of the firm and its advisors to ensure they meet industry standards.

Services Offered by Private Wealth Management Firms

Private wealth management firms offer a range of services to help individuals and families manage their finances and investments effectively. These services are tailored to meet the specific needs and goals of each client, providing personalized solutions for wealth preservation and growth.Investment Management

Private wealth management firms typically offer investment management services, including portfolio construction, asset allocation, and investment selection. They work closely with clients to develop investment strategies that align with their risk tolerance and financial objectives.- Creating diversified investment portfolios tailored to individual client needs.

- Monitoring and adjusting investments based on market conditions and client preferences.

- Providing access to a wide range of investment options, including stocks, bonds, mutual funds, and alternative investments.

Financial Planning

In addition to investment management, private wealth management firms often provide comprehensive financial planning services. This may include retirement planning, tax planning, estate planning, and insurance analysis to help clients achieve their long-term financial goals.- Developing personalized financial plans based on client goals and objectives.

- Reviewing and optimizing retirement savings strategies to ensure a comfortable retirement.

- Implementing tax-efficient investment strategies to minimize tax liabilities.

Wealth Transfer and Estate Planning

Private wealth management firms can also assist clients with wealth transfer and estate planning. They help clients develop strategies to protect and transfer their wealth to future generations tax-efficiently.- Creating wills, trusts, and other estate planning documents to ensure assets are distributed according to client wishes.

- Implementing strategies to reduce estate taxes and maximize the transfer of wealth to heirs.

- Providing guidance on charitable giving and philanthropic initiatives as part of estate planning.

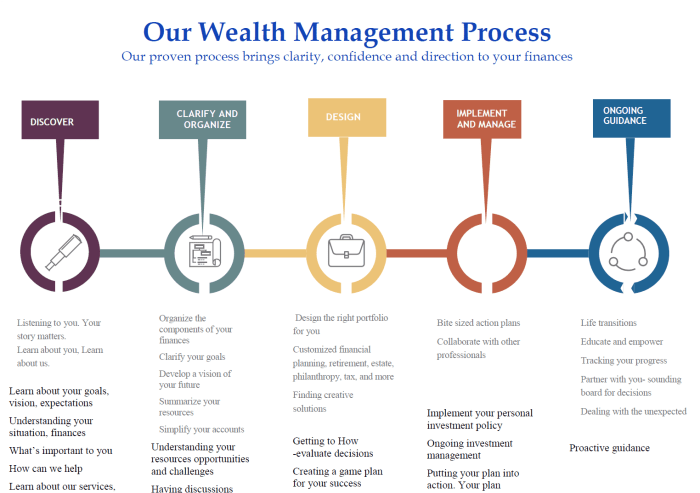

Working with a Private Wealth Manager

Private wealth managers play a crucial role in helping clients manage their financial assets effectively. They provide personalized financial advice, investment strategies, and wealth management services tailored to each client's unique goals and needs.

Establishing a Relationship with a Private Wealth Manager

When establishing a relationship with a private wealth manager, it is important to have open and honest communication. Clients should be transparent about their financial goals, risk tolerance, and expectations. The wealth manager will then create a customized financial plan and investment strategy to help clients achieve their objectives.

Tips for Communicating and Collaborating with a Private Wealth Manager

- Be clear about your financial goals and objectives so that the wealth manager can tailor their advice and strategies to meet your needs.

- Regularly communicate with your wealth manager to provide updates on any changes in your financial situation or goals.

- Ask questions and seek clarification on any financial matters you may not understand. A good wealth manager will take the time to explain complex financial concepts in a way that you can easily grasp.

- Stay informed and be actively involved in the decision-making process. While the wealth manager provides guidance, it is important for clients to understand and feel comfortable with the investment choices being made on their behalf.

- Trust your wealth manager's expertise and experience, but also feel empowered to voice any concerns or preferences you may have regarding your financial plan.

Benefits of Private Wealth Management

Private wealth management offers numerous advantages for individuals seeking to grow and protect their wealth. By working with a private wealth manager, clients can benefit from personalized financial strategies tailored to their specific needs and goals. Let's explore some of the key benefits of engaging in private wealth management services.Customized Financial Planning

Private wealth management firms provide personalized financial planning services that take into account each client's unique financial situation, goals, and risk tolerance. This customized approach allows clients to create a comprehensive financial plan that aligns with their long-term objectives.Investment Expertise

Private wealth managers are highly skilled professionals with expertise in investment management. They can help clients navigate the complexities of the financial markets and make informed investment decisions that are in line with their financial goals. By leveraging the knowledge and experience of a private wealth manager, clients can optimize their investment portfolios for long-term growth.Wealth Preservation

One of the primary goals of private wealth management is to preserve and grow clients' wealth over time. Private wealth managers work diligently to safeguard their clients' assets through diversification, risk management strategies, and continuous monitoring of the financial markets. By prioritizing wealth preservation, private wealth management helps clients protect their financial legacy for future generations.Access to Exclusive Opportunities

Private wealth management firms often provide clients with access to exclusive investment opportunities that may not be available to the general public. These opportunities can include private equity investments, hedge funds, and other alternative investments that have the potential to deliver attractive returns. By leveraging these exclusive opportunities, clients can enhance the diversification and performance of their investment portfolios.Personalized Service and Relationship

Unlike traditional banking services, private wealth management offers a high level of personalized service and attention to each client's individual needs. Private wealth managers build long-term relationships with their clients based on trust, communication, and transparency. This personalized approach ensures that clients receive the tailored guidance and support they need to achieve their financial goals.Closing Summary

In conclusion, Private Wealth Management Near Me: A Complete Overview encapsulates the essence of maximizing your financial potential through tailored services and expert guidance. By embracing the advantages of private wealth management and working closely with dedicated professionals, individuals can navigate the complexities of wealth management with confidence and success.

Popular Questions

What is private wealth management?

Private wealth management involves personalized financial services tailored to high-net-worth individuals to help them grow and protect their wealth effectively.

How do I find a reputable local private wealth management firm?

Consider factors like experience, services offered, and client reviews when researching local firms. Referrals from trusted sources can also be valuable.

What are some examples of customized solutions offered by private wealth management firms?

Examples include estate planning, tax optimization strategies, risk management, and investment portfolio diversification based on individual goals and preferences.