Delve into the realm of Private Wealth Management Strategies for Capital Preservation, where the art of safeguarding wealth takes center stage. Uncover the intricacies and nuances of preserving capital in a dynamic financial landscape, as we navigate through a wealth of strategies and insights.

As we journey through the different facets of private wealth management, from capital preservation tactics to risk management techniques, a tapestry of wealth preservation unfolds before our eyes.

Overview of Private Wealth Management Strategies

Private wealth management is a specialized financial service that caters to the unique needs of high-net-worth individuals and families. It involves creating a comprehensive plan to manage and grow wealth effectively while taking into account the client's financial goals, risk tolerance, and tax considerations.Capital preservation is a crucial aspect of wealth management, especially for high-net-worth individuals who have accumulated significant assets. The primary goal of capital preservation is to protect the initial investment and ensure that wealth is not eroded by market volatility, inflation, or unforeseen events. By implementing strategies focused on preserving capital, individuals can safeguard their wealth and maintain financial security for themselves and future generations.

Private wealth management is a specialized financial service that caters to the unique needs of high-net-worth individuals and families. It involves creating a comprehensive plan to manage and grow wealth effectively while taking into account the client's financial goals, risk tolerance, and tax considerations.Capital preservation is a crucial aspect of wealth management, especially for high-net-worth individuals who have accumulated significant assets. The primary goal of capital preservation is to protect the initial investment and ensure that wealth is not eroded by market volatility, inflation, or unforeseen events. By implementing strategies focused on preserving capital, individuals can safeguard their wealth and maintain financial security for themselves and future generations.Key Goals of Private Wealth Management Strategies

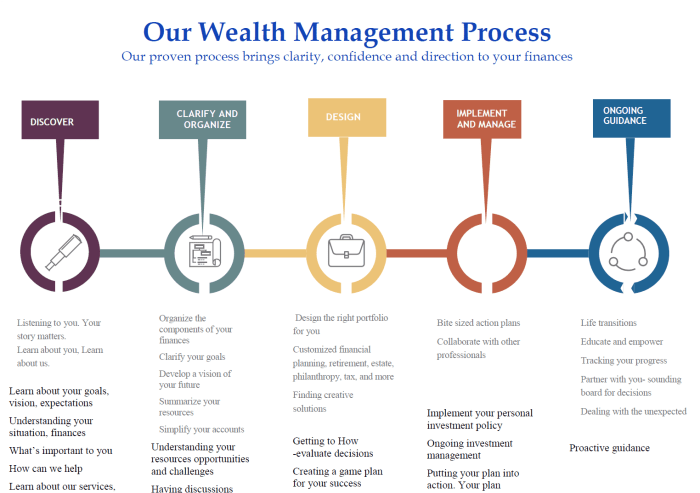

Private wealth management strategies aim to achieve several key goals to help individuals effectively manage their wealth and achieve their financial objectives. These goals include:- Asset Allocation: Developing a diversified investment portfolio tailored to the client's risk profile and financial goals.

- Wealth Preservation: Implementing strategies to protect and preserve the client's assets from market fluctuations and economic uncertainties.

- Tax Optimization: Minimizing tax liabilities through strategic tax planning and efficient use of tax-advantaged investment vehicles.

- Legacy Planning: Creating a comprehensive estate plan to ensure the smooth transfer of wealth to future generations and minimize estate taxes.

- Risk Management: Identifying and mitigating potential risks that could impact the client's financial security and implementing strategies to protect against losses.

Types of Capital Preservation Strategies

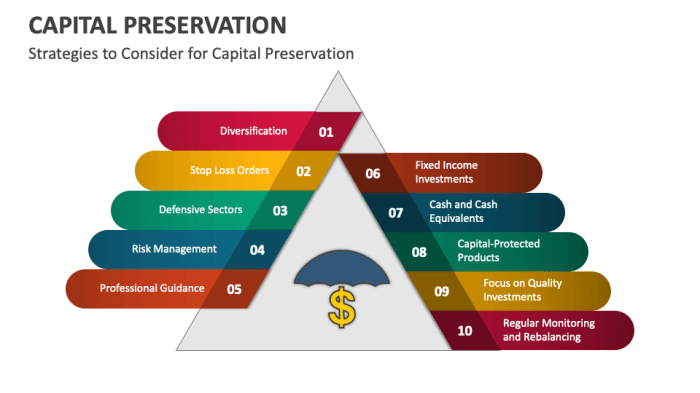

Capital preservation strategies are essential in private wealth management to safeguard investments and minimize risk. These strategies are designed to protect the initial capital invested while aiming for steady growth over time.Active vs. Passive Capital Preservation Strategies

Active capital preservation strategies involve frequent monitoring and adjustments to the investment portfolio. This may include buying and selling assets based on market conditions and economic outlook. On the other hand, passive strategies involve a more hands-off approach, focusing on long-term investments and asset allocation without constant trading.Role of Diversification in Capital Preservation

Diversification is a key component of capital preservation strategies. By spreading investments across different asset classes, industries, and geographic regions, investors can reduce the overall risk in their portfolio. This helps protect against volatility in any single investment and can help mitigate losses during market downturns.Risk Management Techniques

Risk management is a crucial aspect of preserving capital in private wealth management. By identifying, assessing, and mitigating risks, investors can protect their assets from potential losses. One key risk management tool used in this process is hedging.Hedging as a Risk Management Tool

Hedging involves taking offsetting positions in the market to reduce the impact of adverse price movements. This strategy can help investors protect their portfolios from downside risk while still allowing them to participate in potential upside movements. For example, an investor holding a stock position may hedge their risk by purchasing put options on the same stock. If the stock price falls, the put options will increase in value, offsetting some of the losses from the stock position.Examples of Risk Management Techniques

- Diversification: Spreading investments across different asset classes, industries, and geographical regions to reduce concentration risk.

- Asset Allocation: Allocating capital to different asset classes based on risk tolerance and investment goals to achieve a balanced portfolio.

- Stop-Loss Orders: Setting predetermined price levels at which to sell an asset to limit potential losses.

- Insurance: Using insurance products to protect against specific risks, such as life insurance or property insurance.

Tax-Efficient Wealth Preservation

When it comes to preserving wealth, managing taxes efficiently is crucial for maximizing returns and ensuring long-term financial stability. Taxes can significantly impact wealth accumulation and preservation, making it essential for high-net-worth individuals to implement tax planning strategies to minimize their tax burden and protect their assets.Tax-Efficient Strategies

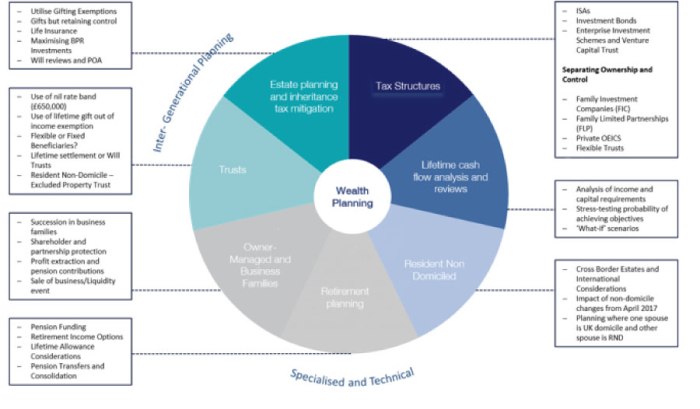

One effective tax-efficient wealth preservation strategy is asset location optimization. By strategically placing assets in tax-advantaged accounts or structures, individuals can minimize their tax liability and maximize their after-tax returns. For example, high-income earners may benefit from investing in tax-deferred retirement accounts or utilizing tax-efficient investment vehicles like index funds or exchange-traded funds (ETFs).Another key tax planning technique is tax-loss harvesting, which involves selling investments that have experienced a loss to offset capital gains and reduce taxable incomeEstate Planning and Wealth Transfer

Estate planning plays a crucial role in private wealth management as it ensures the smooth transfer of assets to future generations while minimizing taxes and other expenses. It involves creating a detailed plan for how your assets will be distributed after your passing, taking into account your wishes and the needs of your heirs.Strategies for Wealth Transfer to Future Generations

- Establishing a will: A will is a legal document that Artikels how your assets will be distributed upon your death. It allows you to specify who will receive your assets and in what proportions.

- Setting up trusts: Trusts are effective tools for wealth transfer as they allow you to control how and when your assets are distributed to your beneficiaries. They also offer privacy and can help minimize estate taxes.

- Gifting assets: Making gifts during your lifetime can help reduce the size of your estate and lower potential estate taxes. It also allows you to see your loved ones benefit from your assets while you are still alive.

Role of Trusts and Other Estate Planning Tools in Capital Preservation

Trusts can help protect your assets from creditors and lawsuits, ensure your assets are used responsibly by your beneficiaries, and provide for loved ones who may not be able to manage their inheritance on their own.

Other estate planning tools, such as powers of attorney and healthcare directives, are also important in ensuring that your wishes are carried out in the event of incapacity or illness. These tools can help protect your assets and ensure they are used according to your wishes.

Investment Vehicles for Capital Preservation

When it comes to preserving capital, choosing the right investment vehicles is crucial. Different options offer varying levels of risk and return, so it's essential to understand how each can contribute to your overall wealth preservation strategy.Bonds, equities, and alternative investments all play a role in capital preservation. Bonds are known for their stability and reliable income stream, making them a popular choice for conservative investors looking to protect their capital. Equities, on the other hand, offer the potential for growth but come with higher risk. Alternative investments, such as real estate or commodities, can provide diversification and protection against market volatility.Asset allocation is key in preserving capital over the long term. By spreading your investments across different asset classes, you can reduce risk and ensure that your portfolio is well-positioned to weather any market conditions. A balanced approach that takes into account your risk tolerance and investment goals is essential for successful capital preservation.Summary

In conclusion, Private Wealth Management Strategies for Capital Preservation offers a roadmap to securing and growing wealth in an ever-changing economic environment. By implementing the right strategies and staying abreast of market trends, individuals can safeguard their capital for future generations to come.

Essential FAQs

What are the key goals of private wealth management strategies?

The key goals include capital preservation, wealth accumulation, risk management, and long-term financial stability.

What is the role of diversification in capital preservation?

Diversification helps spread risk across different assets, reducing the impact of market fluctuations on the overall portfolio.

How do tax-efficient strategies contribute to wealth preservation?

Tax-efficient strategies minimize the tax impact on investment returns, allowing individuals to retain more of their wealth over time.

Why is estate planning important in private wealth management?

Estate planning ensures the orderly transfer of assets to heirs and helps minimize estate taxes, preserving wealth for future generations.

What are some common investment vehicles for capital preservation?

Common investment vehicles include bonds, equities, real estate, and alternative investments like hedge funds or private equity.